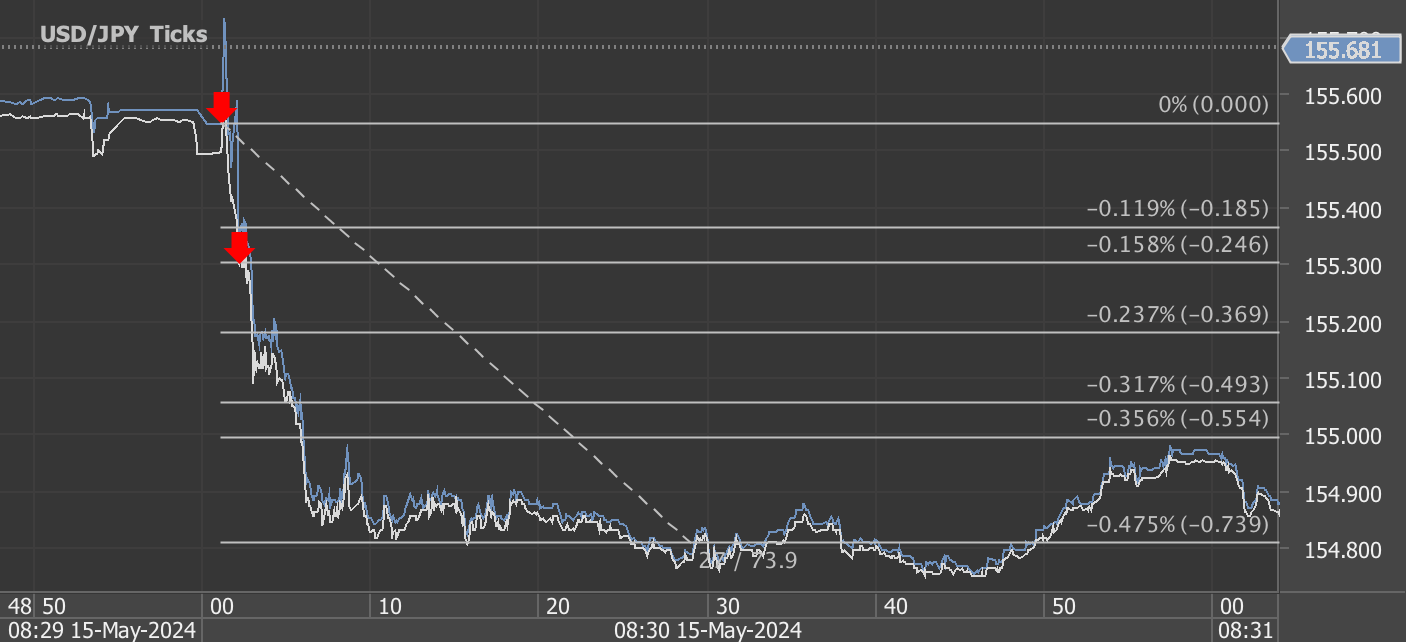

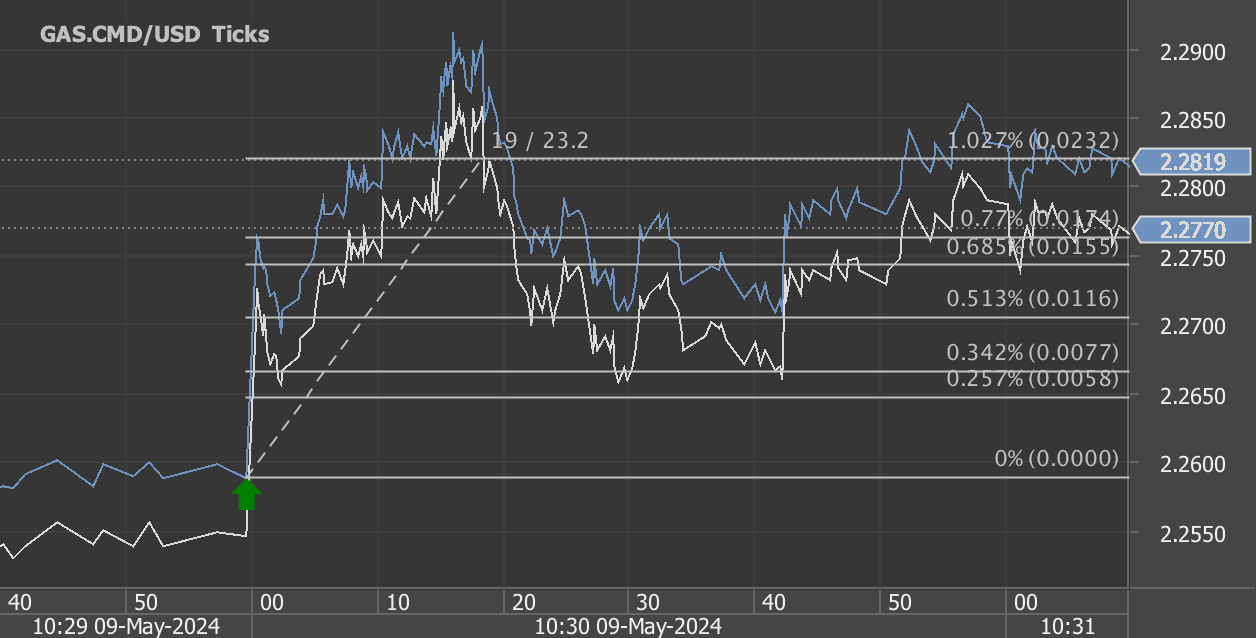

According to our analysis natural gas moved 40 ticks on DOE Natural Gas Storage Report data on 6 June 2024.

Natural gas (40 ticks)

Charts are exported from JForex (Dukascopy).

Weekly Update on U.S. Natural Gas Storage: Trends and Insights as of May 31, 2024

As we close another week, the U.S. Energy Information Administration (EIA) has released its latest Natural Gas Storage Report. This week's data, ending on May 31, 2024, reveals significant trends in the storage of working gas, reflecting both seasonal influences and broader market dynamics.

Current Storage Figures and Regional Breakdown

As of May 31, total working gas in underground storage across the Lower 48 states stood at 2,893 billion cubic feet (Bcf). This is a robust increase of 98 Bcf from the previous week. When we delve into regional data, the distribution and changes become even more insightful:

East: Stocks reached 575 Bcf, with an impressive weekly increase of 37 Bcf.

Midwest: Storage levels rose to 681 Bcf, marking a rise of 29 Bcf over the last week.

Mountain: Smaller but still significant, stocks are at 218 Bcf, up 8 Bcf.

Pacific: Recorded a modest rise of 6 Bcf to reach 273 Bcf.

South Central: Demonstrating the largest regional storage, totals hit 1,146 Bcf, with an increase of 18 Bcf.

These figures underscore a noteworthy increase in storage levels across most regions, particularly in areas like the Pacific and Mountain regions, where percentage increases far outpace other regions.

Historical Comparisons and Market Implications

The current total storage of 2,893 Bcf not only surpasses last week's figures but also shows significant gains over historical benchmarks. This total is 373 Bcf higher than the same time last year and 581 Bcf above the five-year average of 2,312 Bcf. Such a position above the historical average suggests a robust supply scenario which could influence market sentiments and pricing strategies in the natural gas markets.

Year-over-Year: Each region has shown growth compared to last year, with the Mountain and Pacific regions reporting the most substantial relative increases (62.7% and 70.6%, respectively).

Against the Five-Year Average: Here too, the Mountain and Pacific regions standout with increases of 67.7% and 21.3%, respectively, showcasing a trend of growing stockpiles that may impact future supply availability and pricing.

Statistical Considerations

The EIA report also touches on the accuracy and reliability of these figures. The coefficients of variation (CV) for stocks indicate the reliability of the reported quantities. For most regions, the CV remains low, suggesting a high level of confidence in these measurements. Particularly notable is the Pacific region's 0.0% CV, indicating highly reliable data.

Market Outlook

Given the current data, market participants might anticipate stable or potentially lower natural gas prices, barring any unforeseen shifts in market demand or supply disruptions. The significant increase above the five-year average provides a cushion that could help mitigate price volatility in the short term.

In conclusion, the latest report on natural gas storage indicates a healthy supply situation in the U.S. As we head into the summer months, where consumption typically rises, the industry appears well-prepared to meet demand. However, stakeholders should continue to monitor weekly trends and other market indicators to refine their strategies in this dynamic market environment.

Source: https://ir.eia.gov/ngs/ngs.html

Start futures forex fx commodity news trading with Haawks G4A low latency machine-readable data, one of the fastest data feeds for DOE data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.