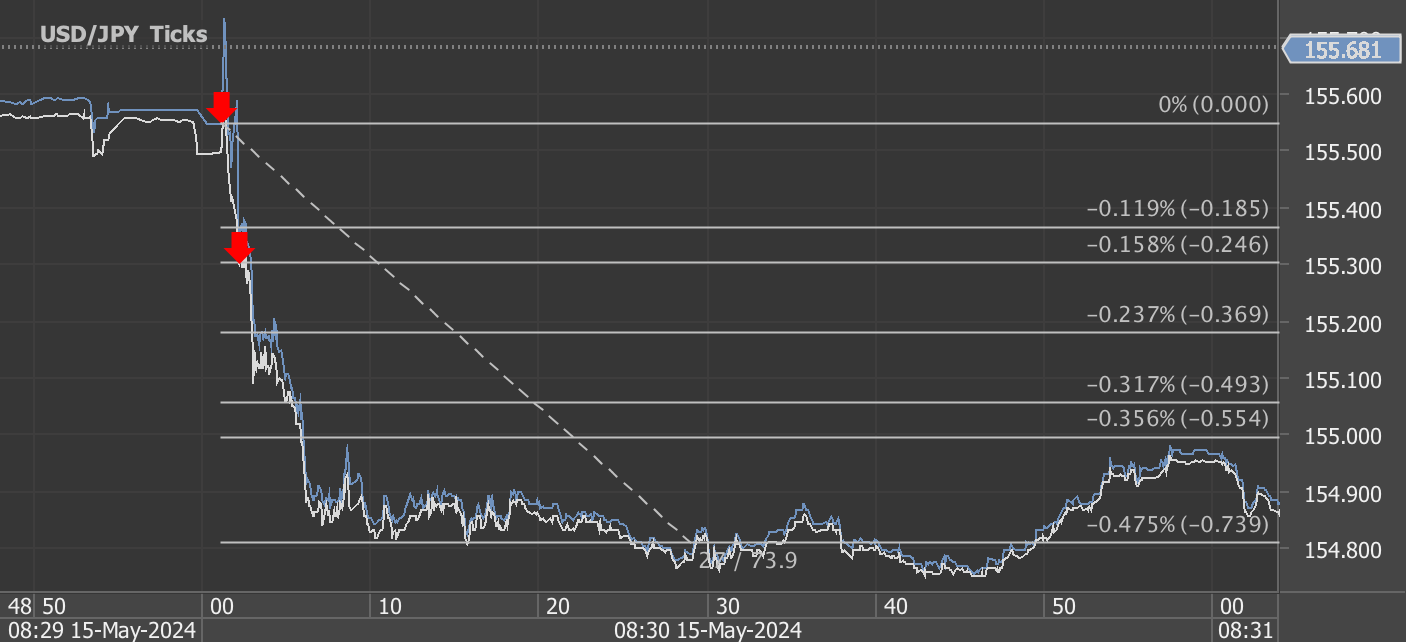

According to our analysis USDJPY and EURUSD moved 104 pips on US Retail Sales and US BLS Consumer Price Index (CPI) data on 15 May 2024.

USDJPY (73 pips)

EURUSD (31 pips)

Charts are exported from JForex (Dukascopy).

Understanding the Latest Economic Indicators: April 2024 CPI and U.S. Retail Sales

The U.S. Bureau of Labor Statistics and the Census Bureau have recently released critical economic data for April 2024, covering the Consumer Price Index (CPI) and retail sales figures. These releases provide a comprehensive snapshot of the current economic environment, highlighting consumer inflation and retail activity. Let's delve into the details of each report and discuss their broader implications.

Consumer Price Index for April 2024

The Consumer Price Index for All Urban Consumers (CPI-U) rose by 0.3 percent in April on a seasonally adjusted basis, following a 0.4 percent increase in March. Annually, the all items index increased by 3.4 percent before seasonal adjustment. Key takeaways include:

Shelter and Gasoline Indexes: These indexes significantly contributed to the monthly CPI rise, with the energy index increasing by 1.1 percent primarily due to these components.

Stable Food Prices: The food index remained unchanged, with a notable decrease in the food at home category, offset by increases in food away from home.

Less Volatile Core Inflation: Excluding food and energy, the core index also rose by 0.3 percent, indicating stable underlying inflation.

Over the past 12 months, the energy index increased by 2.6 percent, while the food index rose by 2.2 percent, highlighting specific areas where consumers may feel budget pressures.

U.S. Retail Sales in April 2024

The advance estimates of U.S. retail and food services sales for April 2024 were virtually unchanged from March, adjusted for seasonal variation, but showed a 3.0 percent increase from April 2023. Highlights from the report include:

Steady Sales Figures: Total sales from February to April 2024 were up 3.0 percent from the same period a year ago, indicating a consistent growth in consumer spending.

Strong Online Sales: Nonstore retailers recorded a robust 7.5 percent increase from the previous year, underscoring the ongoing shift towards online shopping.

Food Services Growth: Food services and drinking places saw a significant 5.5 percent increase year over year, possibly reflecting consumer confidence and increased social activities.

Implications and Outlook

These reports suggest a cautiously optimistic economic outlook. While inflation, as indicated by the CPI, remains present, its growth is steady rather than sharp, suggesting that inflationary pressures might be stabilizing. Meanwhile, the solid performance in retail sales, particularly in nonstore retailers and food services, points to healthy consumer spending, which is crucial for continued economic growth.

However, the stable yet significant inflation highlighted by the CPI could impact consumer purchasing power, especially if wage growth does not keep pace. This dynamic warrants close monitoring as it may influence future consumer spending and economic policy decisions.

As we look towards the future, these indicators will be vital for policymakers, businesses, and consumers alike to gauge the economic landscape and make informed decisions. The next release in June will provide further insights into whether these trends are holding steady or shifting, marking critical data points for economic forecasts and strategies.

Source: https://www.census.gov/retail/sales.html, https://www.bls.gov/news.release/cpi.nr0.htm

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.

Start futures forex fx news trading with Haawks G4A low latency machine-readable data today, one of the fastest news data feeds for US macro-economic and commodity data.