According to our analysis USDJPY and EURUSD moved around 77 pips on US Employment Situation (Non-farm payrolls / NFP) data on 3 May 2024.

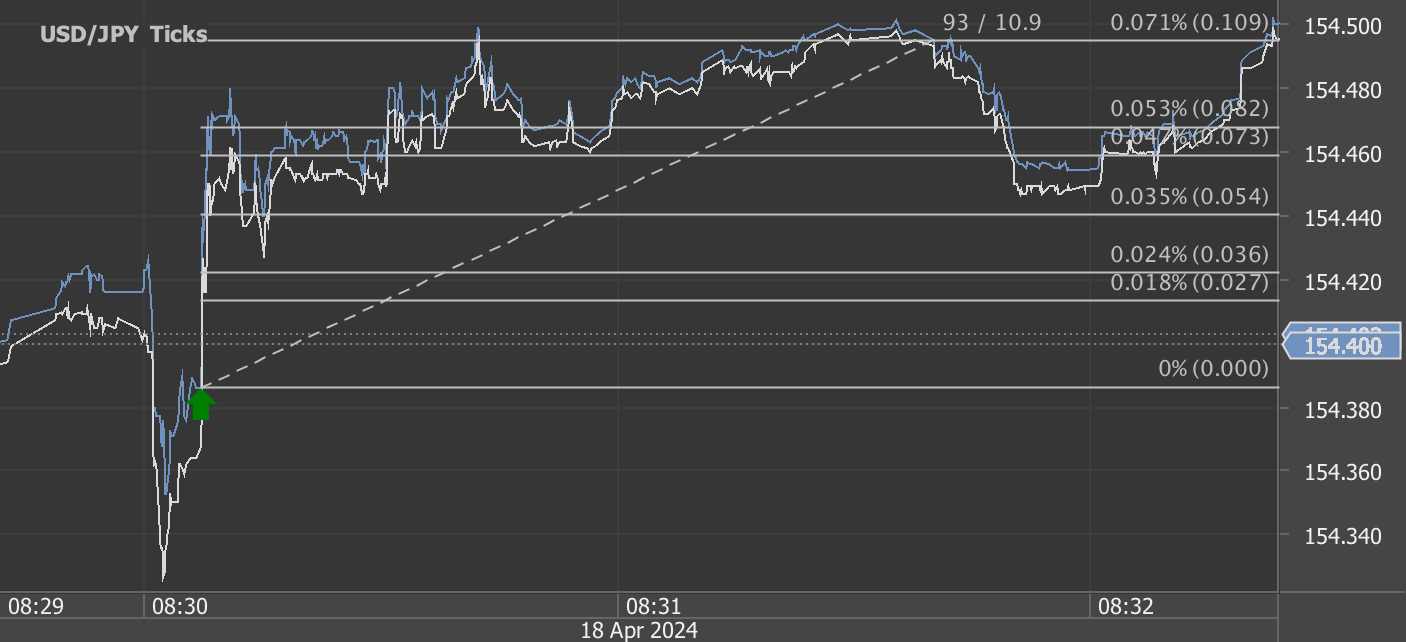

USDJPY (51 pips)

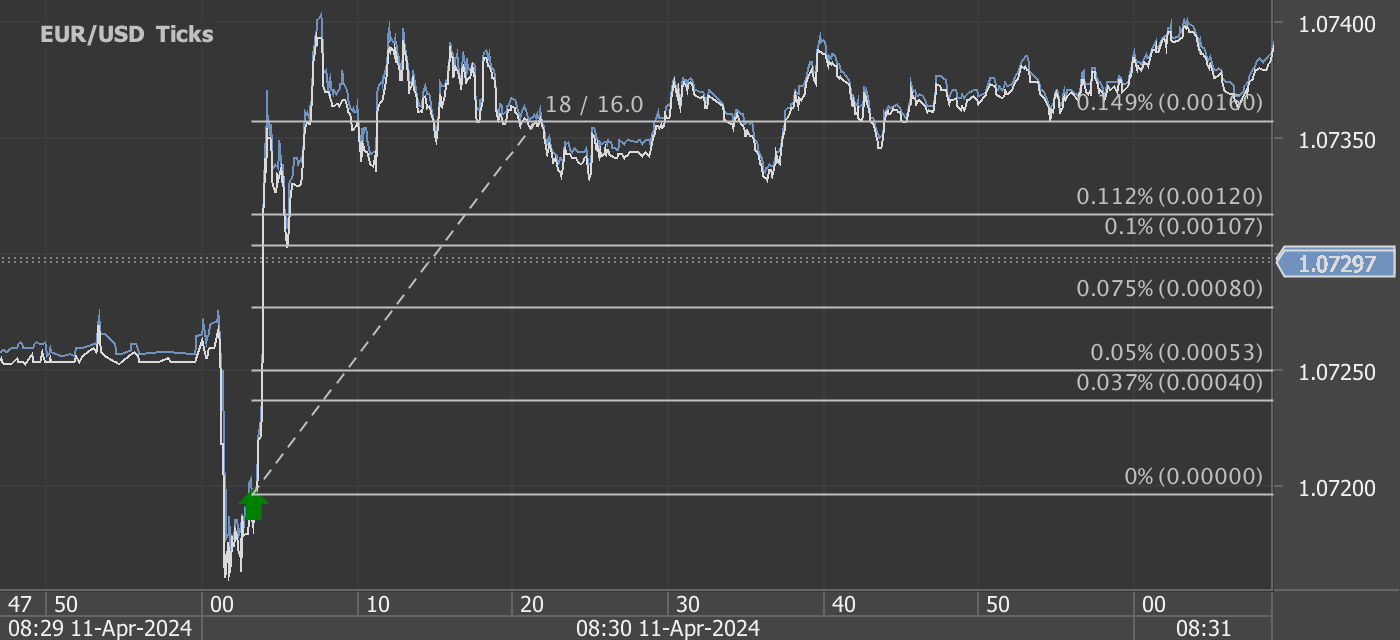

EURUSD (26 pips)

Charts are exported from JForex (Dukascopy).

Analyzing the April 2024 Employment Situation Summary

The latest Employment Situation Summary released by the U.S. Bureau of Labor Statistics provides a mixed bag of insights into the state of the American job market as of April 2024. Total nonfarm payroll employment saw an increase of 175,000 jobs last month, which is notably lower than the average monthly gain of 242,000 over the previous year. This deceleration in job growth may signal a more cautious approach by businesses amidst various economic pressures. However, the unemployment rate remained stable at 3.9%, suggesting a still robust labor market.

Sector-Specific Highlights

Health Care: The health care sector continued to show strong performance with 56,000 new jobs added in April. This sector's resilience is critical as it aligns with ongoing demands in health services, especially in ambulatory health care services and hospitals.

Social Assistance: This sector also saw significant growth, adding 31,000 jobs, indicating ongoing needs in community and social services. The consistent job additions in social assistance reflect the growing societal emphasis on supportive services.

Transportation and Warehousing: With a 22,000 job increase, this sector shows a modest rebound, likely driven by the ongoing shifts in consumer delivery preferences and supply chain adjustments.

Retail Trade: Notably, the retail trade has picked up momentum with a 20,000 increase in jobs, led by gains in general merchandise and building material stores. This could be an indicator of consumer confidence and spending.

Challenges and Steady Sectors

Despite these positive trends, certain sectors like construction and government showed only slight changes in employment numbers. The construction sector's small gain of 9,000 jobs suggests a slowdown possibly linked to material costs or interest rate concerns. Government employment also showed minimal change, indicating a potential plateau in public sector hiring.

Economic Indicators and Wage Analysis

A key takeaway from the report is the slight increase in average hourly earnings, up 7 cents to $34.75, representing a 3.9% increase year-over-year. This gradual wage growth indicates ongoing adjustments to inflationary pressures but could also point to cautious employer spending in salary increments.

The average workweek slightly decreased by 0.1 hours to 34.3 hours, a subtle sign that businesses might be adjusting labor hours to manage costs or productivity demands.

Looking Ahead

As we move forward, the labor market appears to be balancing cautious employer behavior with steady consumer activity. The sectors showing growth highlight areas of economic strength, while the overall slowdown in job additions could suggest a market awaiting clearer economic signals.

For policymakers and business leaders, these insights provide a nuanced perspective on workforce dynamics as they plan for potential economic shifts. For workers, the steady yet selective growth in sectors may influence decisions on skill development and job opportunities.

As we look to the next Employment Situation Summary due in June, all eyes will be on whether these trends hold steady or if new economic factors will emerge, influencing job market trajectories in mid-2024.

Start forex fx futures news trading with Haawks G4A low latency machine-readable data today, one of the fastest news data feeds for US economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.