Unlock Market Potential: Experience Ultra-Fast, Machine-Readable Data for News Trading

Haawks G4A is a unique, robust, low-latency machine-readable news trading data feed which reports directly from the source. We are proud to offer one of the fastest machine-readable news trading feeds for macro-economic and commodity data from the United States (US), Canada (CA) and Europe. The majority of our news releases beat the competition by hundreds of milliseconds, in recent years even seconds.

Enhance Your Trading Strategy with Cutting-Edge Technology and Market Insight

At Haawks, we leverage superior technology combined with deep market insights to offer you a distinct competitive advantage. Our data feed enables traders to execute transactions swiftly, gaining entry to the market ahead of 99% of participants. This strategic early entry allows our clients to capitalize on opportunities and secure profits efficiently.

Key Benefits of Choosing Haawks:

Strategic Market Entry: Our advanced algorithms ensure you trade faster and enter the market at opportune moments, maximizing your potential for profit.

Focused Risk Management: Concentrate on high-probability trades with our analytics that highlight significant deviations from forecasts and demonstrate robust historical performance. Sign up today for our complimentary monthly news trading analysis.

Minimized Holding Periods: Limit your exposure to market volatility with our strategy that focuses on brief holding periods, ranging from seconds to single-digit minutes.

Effective Hedging Strategies: Safeguard your medium and long-term positions with futures, or secure profits in adverse market conditions.

Trusted by Professionals: Our data feed is preferred by professional news traders for its reliability and the substantial profits it can generate. Each month, our clients witness tangible benefits from our services.

Join the exclusive circle of Haawks clients to enjoy a personalized experience and premium support from our boutique operation. Harness the power of our advanced trading platform and gain the edge you need to succeed.

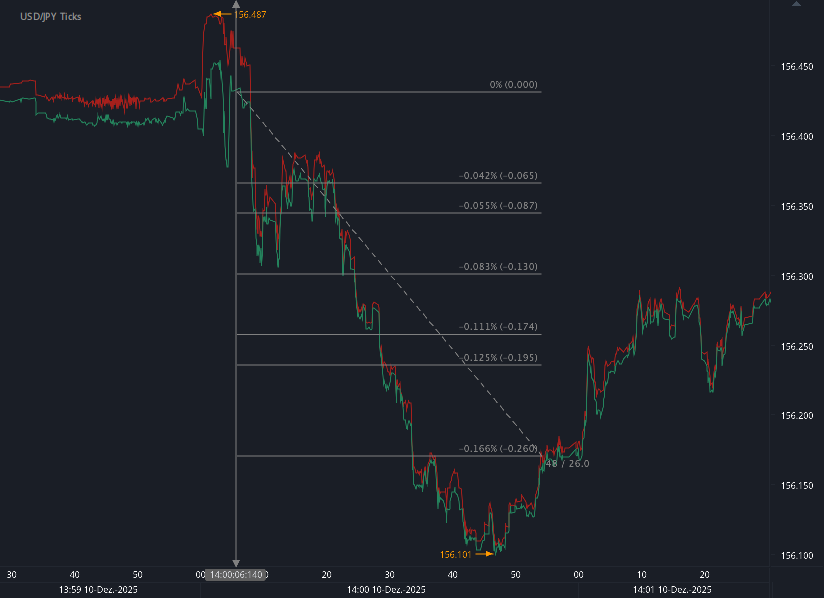

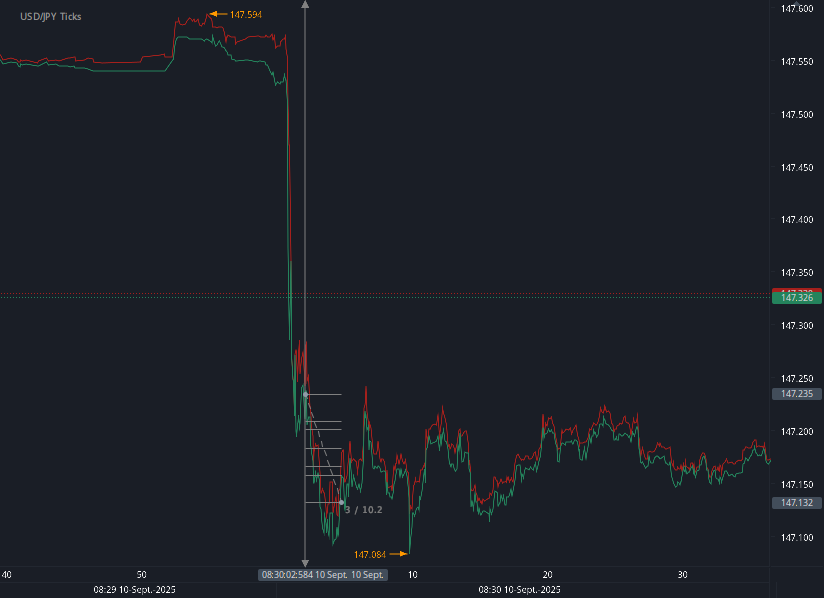

G4A performance 2025

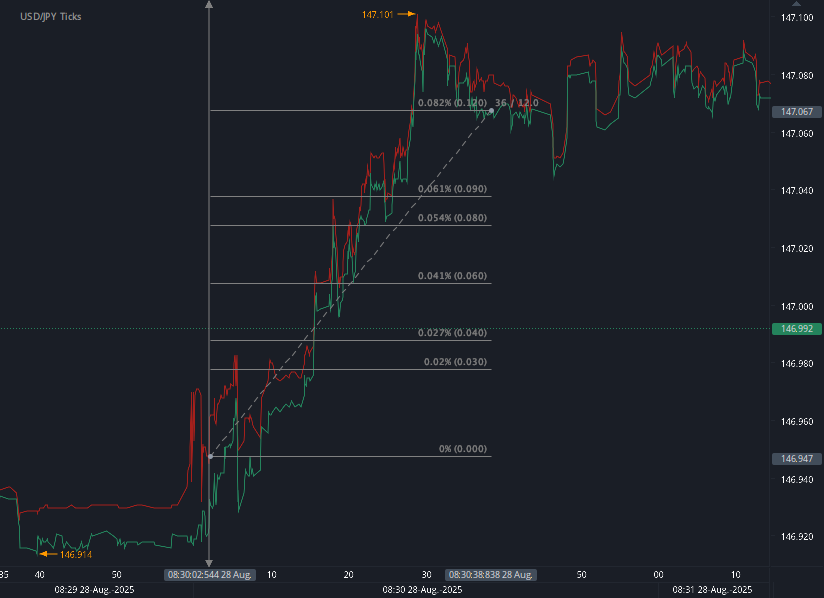

G4A performance 2024

Enhance Your Trading Strategies with Haawks: Premier Low-Latency Economic and Commodity Data

At Haawks, we are excited to offer machine-readable macroeconomic and commodity data that is essential for news-event based algorithmic and manual trading across various asset classes, including Forex, Equities, Interest Rates, Energy, and Agriculture. Our data solutions are engineered to provide the lowest latencies in the industry for critical releases such as US macro-economic news, DOE/EIA Petroleum (WPSR), DOE/EIA Natural Gas (WNGSR), USDA WASDE and USDA Grains Stocks reports (including corn, wheat, soybeans, and cotton). This high-impact, market-moving data is tailored to enhance your trading decisions and improve overall market performance.

Key Highlights:

Unmatched Speed: Our service delivers the fastest access to essential macro-economic and commodity data, ensuring you receive information ahead of the market curve.

Comprehensive Coverage: Gain insights from a wide array of asset classes and major commodity reports to inform your trading strategies.

Reliability: Trust in our robust feed, which consistently delivers low-latency data crucial for high-frequency trading environments.

If you are interested in experiencing the competitive edge our data can provide, we are pleased to offer a complimentary trial period. This allows you to assess our performance firsthand and see how our services can meet your trading needs.

The following data packages are available:

US Economy (BLS, BEA, CB, DOL, UOM, FOMC)

US Energy (US Department of Energy / DOE, EIA)

US Grains (US Department of Agriculture / USDA)

Canada Economy (Statistics Canada)

Europe Economy (European Central Bank (ECB), Central Bank of Turkey (TCMB), Norges Bank, Swiss National Bank (SNB), Norway Statistics, Sweden Statistics)

These packages include releases like US BLS Employment Situation (Non-Farm Payrolls / NFP), US BLS Consumer Price Index (CPI), US BLS Producer Price Index (PPI), US Retail Sales, US Durable Goods Orders, Philadelphia (Philly) Fed Manufacturing Business Outlook Survey, University Michigan Consumer Sentiment Index and Inflation Expectations, US BEA Gross Domestic Product (GDP), US BEA Personal Income and Outlays (PIO) including Core PCE Price Index, US FOMC Interest Rates, Statement and Projections (Median Federal Funds Rate, GDP, Core PCE Inflation, Unemployment Rate and Midpoint Target Range Dots), US DOE / EIA Petroleum Status Report (WPSR), US DOE / EIA Natural Gas Storage Report (WNGSR), USDA WASDE (World Agricultural Supply And Demand Estimates), USDA Grain Stocks, USDA Prospective Plantings, USDA Acreage, CA Gross Domestic Product (GDP), CA Consumer Prices Index (CPI), CA Retail Sales and ECB Interest Rates and Statement.

All data is machine-readable and available via API access in Chicago (Aurora, CH1), New York (NY2/4) and London (LD4/5).

Integration of our data feed is very simple and hassle free for multiple programming languages (e.g. C, C++, .NET, Java, Python). Setup takes 5 minutes with our Python script or integration with Microsoft Excel.

Please contact our sales team for more information and a free trial.

Explore Our Latest Insights on the Haawks Blog

We invite you to visit our blog for comprehensive analysis of the latest news releases, including detailed market reactions and latency comparisons. Stay informed with our expert commentary and deepen your understanding of how these factors can impact your trading strategy.