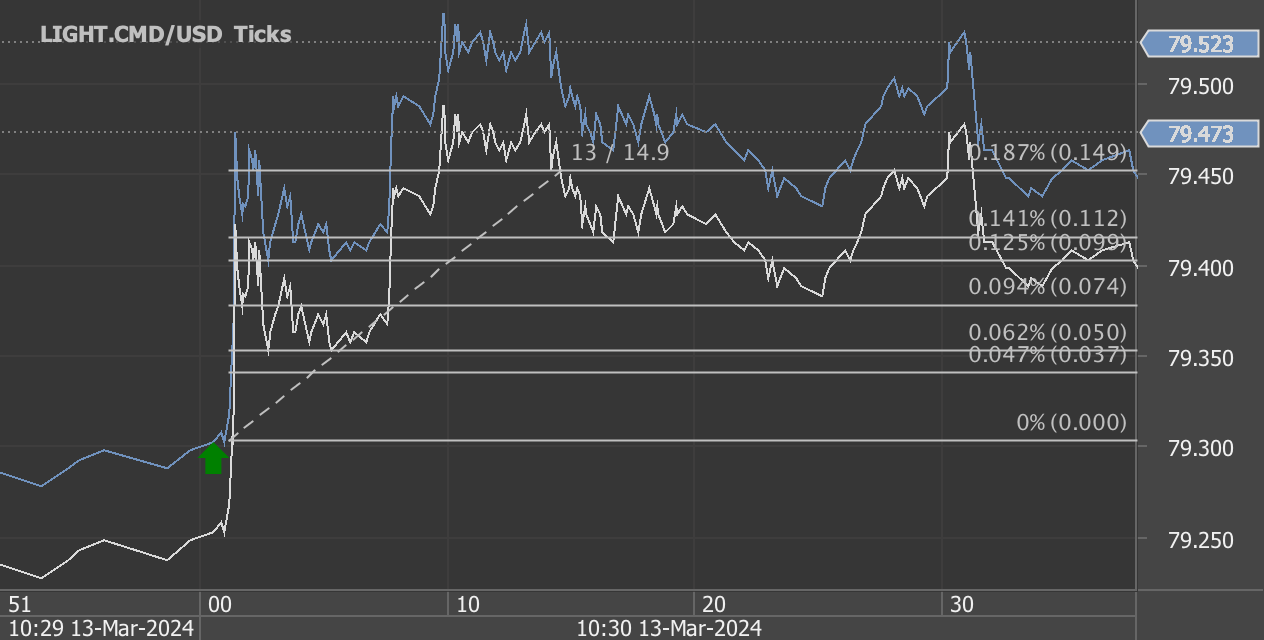

According to our analysis crude oil moved 29 ticks on DOE Petroleum Status Report data on 13 March 2024.

Light sweet crude oil (14 ticks)

Brent crude oil (15 ticks)

Charts are exported from JForex (Dukascopy).

Analyzing the Latest Weekly Petroleum Status Report: Trends and Impacts

The Energy Information Administration (EIA) has released its Weekly Petroleum Status Report for the week ending March 8, 2024, providing key insights into the U.S. petroleum market's dynamics. This analysis aims to decode the numbers, examining refinery operations, inventory levels, imports, prices, and what these trends indicate for consumers and the broader energy sector.

U.S. Refinery Inputs and Production Levels

Refinery operations have seen an uptick, with crude oil inputs averaging 15.7 million barrels per day, marking a 390,000 barrels per day increase from the prior week. This surge pushes refinery utilization to 86.8% of their capacity, signaling a robust demand for petroleum products. Gasoline and distillate fuel production also rose, averaging 9.9 million and 4.6 million barrels per day, respectively, pointing towards a strengthening supply side in the market.

Imports and Inventory Levels

A notable shift occurred in crude oil imports, which averaged 5.5 million barrels per day last week, a significant decrease from the previous week. This change suggests a tightening in the global crude supply or shifts in U.S. import strategies. Conversely, the overall inventory levels depict a complex scenario: while crude oil inventories dropped by 1.5 million barrels, signaling a decrease in supply, propane/propylene inventories rose, indicating varied demand across different petroleum products.

Prices: A Mixed Bag for Consumers and Businesses

The price dynamics reveal a mixed impact for consumers and businesses. West Texas Intermediate (WTI) crude oil experienced a slight decrease, standing at $78.96 per barrel. Meanwhile, gasoline and heating oil spot prices saw a decline, potentially translating to modest relief for consumers at the pump. However, the national average retail prices for gasoline and diesel moved in opposite directions, highlighting the intricate balance between supply, demand, and geopolitical factors influencing the energy markets.

What This Means Moving Forward

The latest data from the EIA suggests a few key trends and their potential impacts:

Refinery Activity Increase: The rise in refinery inputs and capacity utilization points to an optimistic outlook for fuel supply in the domestic market. However, this increase must be sustained to meet growing demand as the economy continues to recover.

Inventory and Import Fluctuations: The drop in crude oil imports and certain inventory levels may raise concerns about supply tightness. Stakeholders should monitor these trends closely, as prolonged decreases could pressure prices upward.

Price Variability: The mixed signals in price movements underscore the volatile nature of the petroleum market. Consumers and businesses alike should remain prepared for fluctuations in fuel costs, which could impact spending and operational decisions.

Conclusion

The Weekly Petroleum Status Report paints a picture of a recovering but still volatile petroleum market. As the U.S. and global economies navigate post-pandemic landscapes, energy markets will continue to be at the mercy of supply and demand shifts, geopolitical tensions, and policy changes. Stakeholders, from consumers to industry leaders, must stay informed and agile, ready to adapt to the ever-changing energy landscape.

Source: https://www.eia.gov/petroleum/supply/weekly/pdf/highlights.pdf

Start futures forex fx crude oil news trading with Haawks G4A low latency machine-readable data, one of the fastest data feeds for DOE Petroleum Status Report data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.