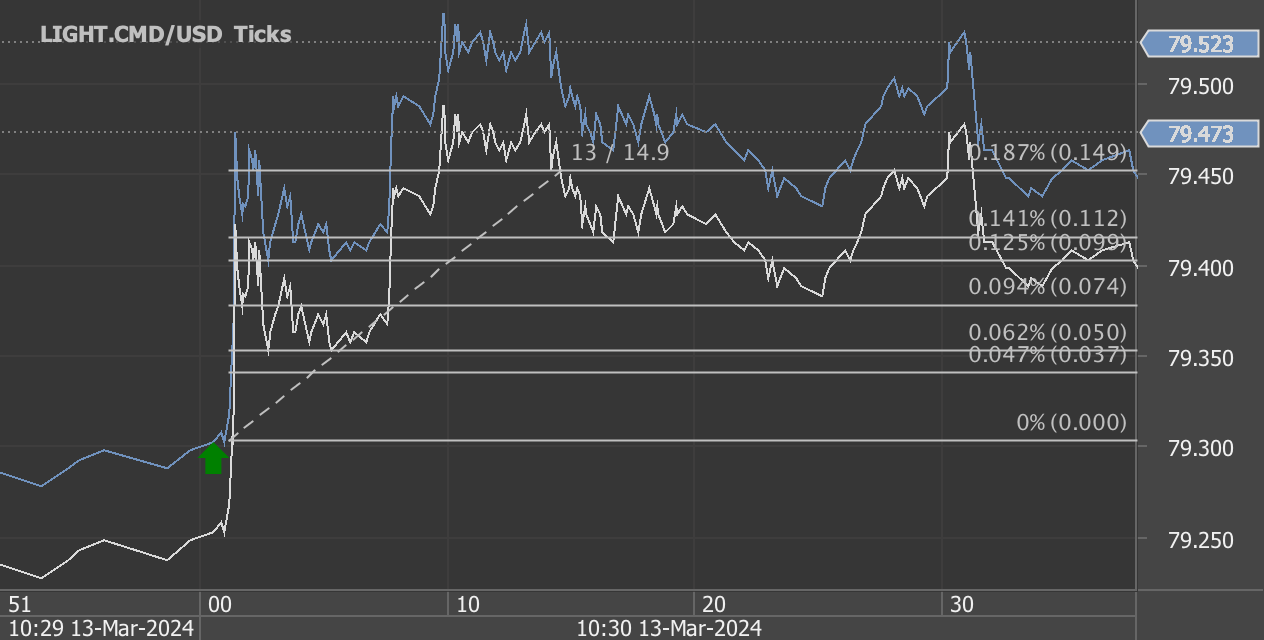

According to our analysis crude oil moved 38 ticks on DOE Petroleum Status Report data on 10 April 2024.

Light sweet crude oil (19 ticks)

Brent crude oil (19 ticks)

Charts are exported from JForex (Dukascopy).

Analyzing the Latest Trends in the U.S. Petroleum Status for Early April 2024

The U.S. Energy Information Administration's Weekly Petroleum Status Report for the week ending April 5, 2024, provides critical insights into the country's petroleum industry, reflecting changes in refinery operations, stock levels, imports, and pricing that signify broader economic and operational trends. This analysis deciphers the key highlights and their potential implications for the market and consumers.

Refinery Inputs and Operations

U.S. crude oil refinery inputs averaged 15.8 million barrels per day, a slight decline from the previous week, indicating a minor adjustment in refining activity. This corresponds with refineries operating at 88.3% of their operable capacity, a marginal increase from the week before, yet noteworthy for understanding the refining sector's response to market demand.

Production and Stock Levels

The report highlights a decrease in gasoline production, now averaging 9.4 million barrels per day, and an increase in distillate fuel production, averaging 4.6 million barrels per day. This shift suggests a nuanced balancing act by refineries to meet the diverse demands of the market, where gasoline sees a slight pullback, and distillate fuels, crucial for industrial and heating purposes, see an uptick.

U.S. commercial crude oil inventories experienced a notable increase of 5.8 million barrels, suggesting a temporary oversupply or decreased demand. This adjustment brings inventories slightly below the five-year average for this time of year, indicating a relatively stable stock level amidst fluctuating market dynamics.

Imports and Product Supplied

A dip in crude oil imports to an average of 6.4 million barrels per day reflects the global interplay of supply chains affecting U.S. oil stocks. The decrease in total motor gasoline imports and a marginal rise in distillate fuel imports further underscore the shifting landscape of domestic consumption versus import reliance.

The four-week average of products supplied to the market slightly decreased, indicating a minor reduction in overall petroleum product demand compared to the same period last year. This subtle shift could signal changes in consumer behavior or broader economic trends influencing energy consumption.

Pricing Dynamics

Crude oil and petroleum product prices offer a lens into the market's supply and demand balance. West Texas Intermediate crude oil saw a price increase to $87.69 per barrel, reflecting tighter supply or increased demand conditions. Similarly, the rise in the spot prices for gasoline and heating oil in New York Harbor points to regional demand pressures or supply constraints.

The national average retail prices for gasoline and diesel fuel, both showing moderate changes from the previous week, paint a picture of the retail fuel market's response to upstream price movements and demand factors.

Conclusion

The early April 2024 snapshot of the U.S. petroleum status delineates a complex interplay of refinery operations, stock adjustments, imports, and price movements. These indicators not only reflect the current state of the petroleum sector but also offer insights into potential economic, environmental, and consumer trends. As the market continues to adapt to varying demand levels and supply chain challenges, stakeholders across the spectrum will be watching closely to navigate the volatile energy landscape effectively.

Source: https://www.eia.gov/petroleum/supply/weekly/pdf/highlights.pdf

Start futures forex fx crude oil news trading with Haawks G4A low latency machine-readable data, one of the fastest data feeds for DOE Petroleum Status Report data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.