According to our analysis USDJPY and EURUSD moved 43 pips on US Factory Orders data on 5 March 2024.

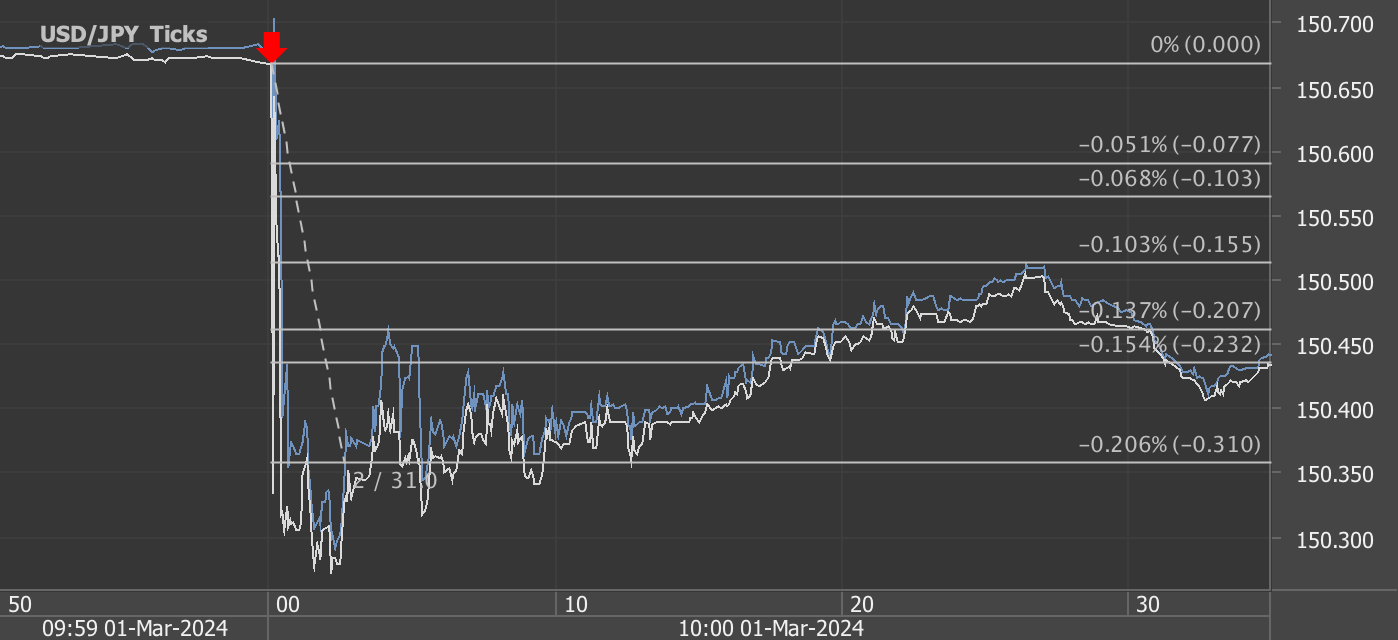

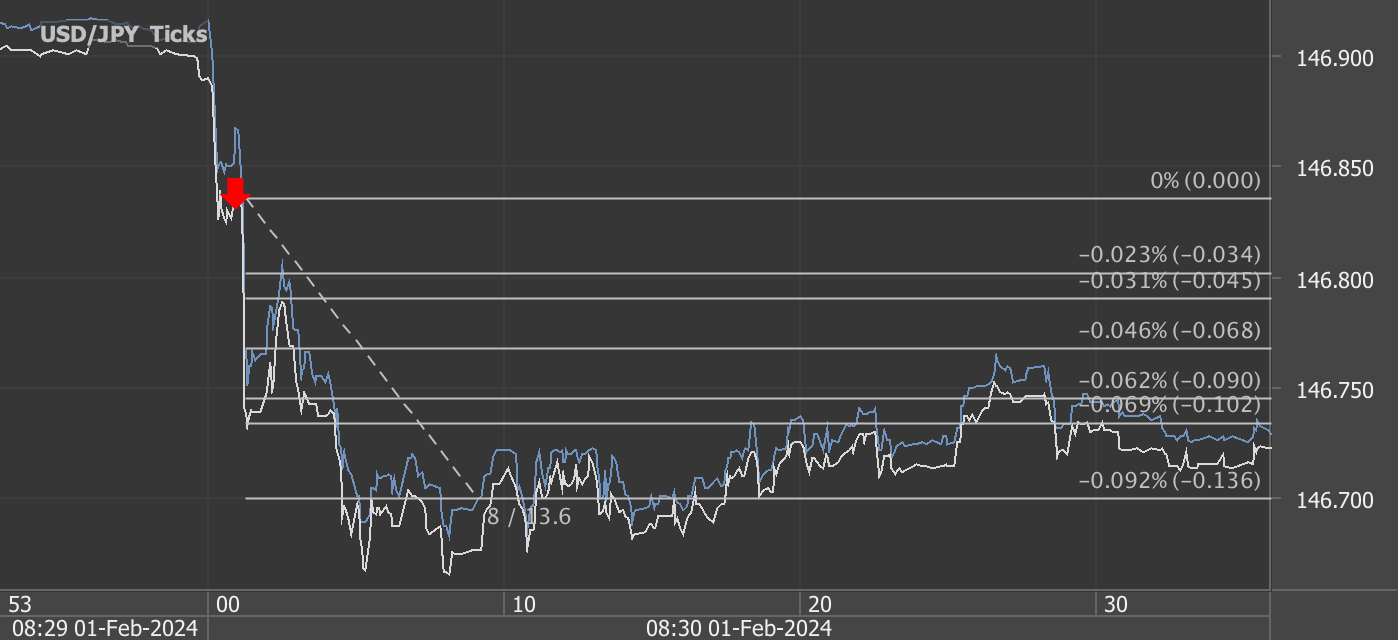

USDJPY (21 pips)

EURUSD (22 pips)

Charts are exported from JForex (Dukascopy).

Analyzing the Latest Trends in U.S. Manufacturing: January Report Overview

The U.S. Census Bureau's recent release on manufacturers’ shipments, inventories, and orders for January reveals a mixed bag of results, painting a complex picture of the manufacturing sector at the start of 2024. Here's a breakdown of the key figures and what they might mean for the industry and the broader economy.

New Orders Decline

January saw a significant decrease in new orders for manufactured goods, dropping $21.5 billion or 3.6 percent to $569.7 billion. This marks the third decline in the last four months, following a modest 0.3 percent decrease in December. The continued downturn in new orders could signal a cooling demand for manufactured goods, possibly reflecting broader economic headwinds or cautious consumer spending. It's a development that warrants close monitoring, as persistent declines could impact production levels and employment in the manufacturing sector.

Shipments on the Downswing

The report also highlighted a decrease in shipments, which fell $5.7 billion or 1.0 percent to $572.3 billion, marking the fourth decline in the last five months. This continued decrease, following a 0.5 percent drop in December, suggests that manufacturers might be adjusting their outputs in response to the slowing demand. The shipments data is crucial as it reflects the volume of goods being distributed for sale, indicating the immediate health of the manufacturing sector.

Unfilled Orders Increase

In contrast to the declines in new orders and shipments, unfilled orders for manufactured goods have shown resilience, increasing $2.1 billion or 0.2 percent to $1,395.1 billion. This increase, observed for thirteen of the last fourteen months, points to a backlog of orders waiting to be completed. The unfilled orders-to-shipments ratio also rose to 7.18 from 7.10 in December, suggesting that manufacturers are facing a growing queue of orders. While on one hand, this can indicate healthy demand, it also raises questions about capacity constraints and potential delays in fulfilling orders.

Inventories Dip Slightly

Inventories saw a minor decrease of $0.8 billion or 0.1 percent to $855.8 billion, marking the second consecutive month of declines. This slight decrease in inventories, following a virtually unchanged December, could suggest that manufacturers are cautiously managing their stock in response to the uncertain demand environment. The inventories-to-shipments ratio increased slightly to 1.50 from 1.48 in December, indicating that companies might be holding more stock relative to their sales, possibly as a buffer against supply chain disruptions.

What This Means Moving Forward

The January 2024 report underscores the challenges and uncertainties facing the manufacturing sector. The decline in new orders and shipments could be early signs of a softening economy or reflect specific sectoral shifts. However, the increase in unfilled orders suggests that there remains a solid foundation of demand, albeit with potential delivery delays.

Looking ahead, manufacturers will need to navigate these mixed signals carefully, balancing production with demand while managing inventories smartly to avoid excesses or shortages. Additionally, the sector will likely keep a close eye on economic indicators and consumer sentiment to gauge future demand trends.

As we move further into 2024, the manufacturing sector's performance will be crucial in signaling the direction of the broader U.S. economy. Stakeholders across the industry will be watching closely to see how these trends develop and what they mean for manufacturing and economic growth in the months ahead.

Source: https://www.census.gov/manufacturing/m3/current/index.html

Start futures forex fx news trading with Haawks G4A low latency machine-readable data, one of the fastest machine-readable news trading feeds for US economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.