According to our analysis there was a potential of 262 pips / ticks profit out of the following 6 events in January 2024. The potential performance in 2023 was 13,607 pips / ticks.

January 2024

US BLS Job Openings and Labor Turnover Survey (JOLT) (28 pips / 3 January 2024)

US Employment Situation (Non-farm payrolls / NFP) (74 pips / 5 January 2024)

USDA WASDE (World Agricultural Supply and Demand Estimates) and USDA Grain Stocks (48 ticks / 12 January 2024)

DOE Petroleum Status Report (44 ticks / 18 January 2024)

University Michigan Consumer Sentiment / Inflation Expectations (20 pips / 19 January 2024)

US Gross Domestic Product (GDP) (48 pips / 25 January 2024)

Total trading time would have been around 4 minutes! (preparation time not included)

Navigating the Waves of Economic Data: Understanding Market Reactions

In the dynamic world of finance, economic reports are the beacons that guide market participants through the turbulent seas of global markets. The beginning of 2024 has already showcased significant market reactions to key U.S. economic data releases, underscoring the importance of staying informed and agile in the face of new information. Let's delve into some of the pivotal reports that have shaped market movements recently and explore their broader implications.

US BLS Job Openings and Labor Turnover Survey (JOLT)

On January 3, 2024, the market witnessed a 28 pips movement in response to the Job Openings and Labor Turnover Survey (JOLT) released by the Bureau of Labor Statistics. This report, a critical gauge of labor market health, offers insights into job vacancies, hires, and separations. Such data is indispensable for understanding the underlying dynamics of the labor market, influencing monetary policy decisions and investor sentiment alike.

US Employment Situation (Non-farm payrolls / NFP)

The Non-farm Payroll (NFP) report, released on January 5, led to a 74 pips fluctuation, reflecting its status as one of the most anticipated economic indicators. The NFP measures employment changes in the U.S. economy, excluding farm workers and several other categories. Its significant impact on markets stems from its ability to sway Federal Reserve policy, affecting interest rates, inflation expectations, and overall economic outlook.

USDA WASDE and Grain Stocks Reports

Agricultural markets were not left untouched, with the USDA's World Agricultural Supply and Demand Estimates (WASDE) and Grain Stocks reports on January 12 causing a 48 ticks movement. These reports provide critical information on agricultural production, stocks, and price forecasts, influencing commodity markets and related sectors. Investors and producers alike scrutinize these releases to make informed decisions in a sector that is highly susceptible to changes in supply and demand dynamics.

DOE Petroleum Status Report

The Department of Energy's Petroleum Status Report on January 18 resulted in a 44 ticks movement, highlighting the energy sector's sensitivity to supply and demand shifts. This weekly report offers insights into crude oil inventories, production, and imports - key factors that directly impact oil prices and, by extension, the broader energy market and economic environment.

University of Michigan Consumer Sentiment

The University of Michigan's Consumer Sentiment and Inflation Expectations survey, released on January 19, led to a 20 pips movement. This indicator is a vital measure of consumer confidence, influencing consumption patterns and serving as a predictor of future economic activity. Changes in consumer sentiment can affect retail sales, housing markets, and overall economic growth, making this report a closely watched indicator.

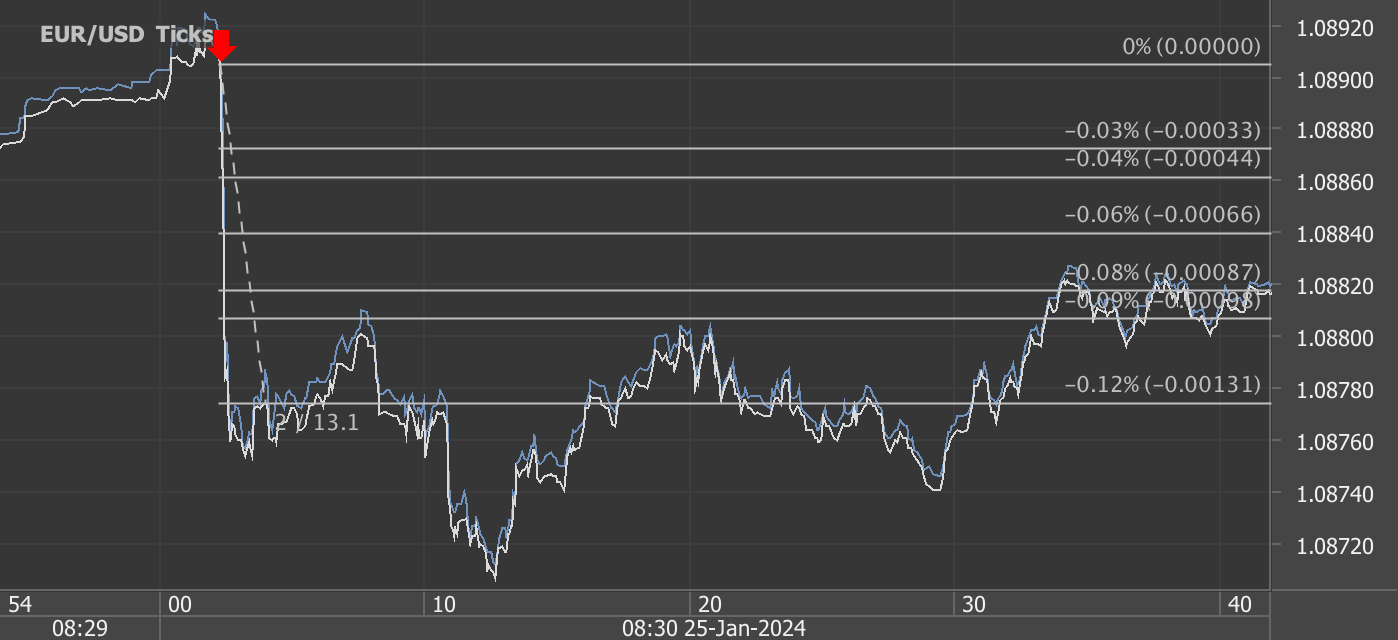

US Gross Domestic Product (GDP)

Lastly, the U.S. Gross Domestic Product (GDP) report on January 25 caused a 48 pips shift, underscoring the paramount importance of GDP data in assessing the economy's health. As the broadest measure of economic activity, GDP growth rates directly influence investment decisions, policy making, and market sentiment. This report provides a comprehensive overview of the economy's performance, offering insights into trends in growth and potential future directions.

Conclusion

The early days of 2024 have already provided a vivid illustration of how economic data releases can drive market volatility. For investors, traders, and policymakers, understanding these reports is crucial for navigating the financial markets successfully. Each piece of data not only offers a snapshot of current conditions but also signals potential future trends. As we continue to sail through the year, staying informed and adaptive to new information will be key to making informed decisions in the ever-evolving landscape of global finance.

Disclaimer: This blog post is for informational purposes only and should not be construed as financial advice. Always conduct thorough research and consider seeking advice from a financial professional before making any investment decisions.

Start futures/forex/oil/grains news trading with Haawks G4A low latency machine-readable data today, we offer one of the fastest machine-readable data feeds for US economic and commodity data and economic data from Norway, Sweden, Turkey and ECB interest rates and statement.

Please let us know your feedback and check out our G4A low latency data feed.

All data is machine readable and available via API access in Aurora, CH1, NY4 and LD4. Free trials.