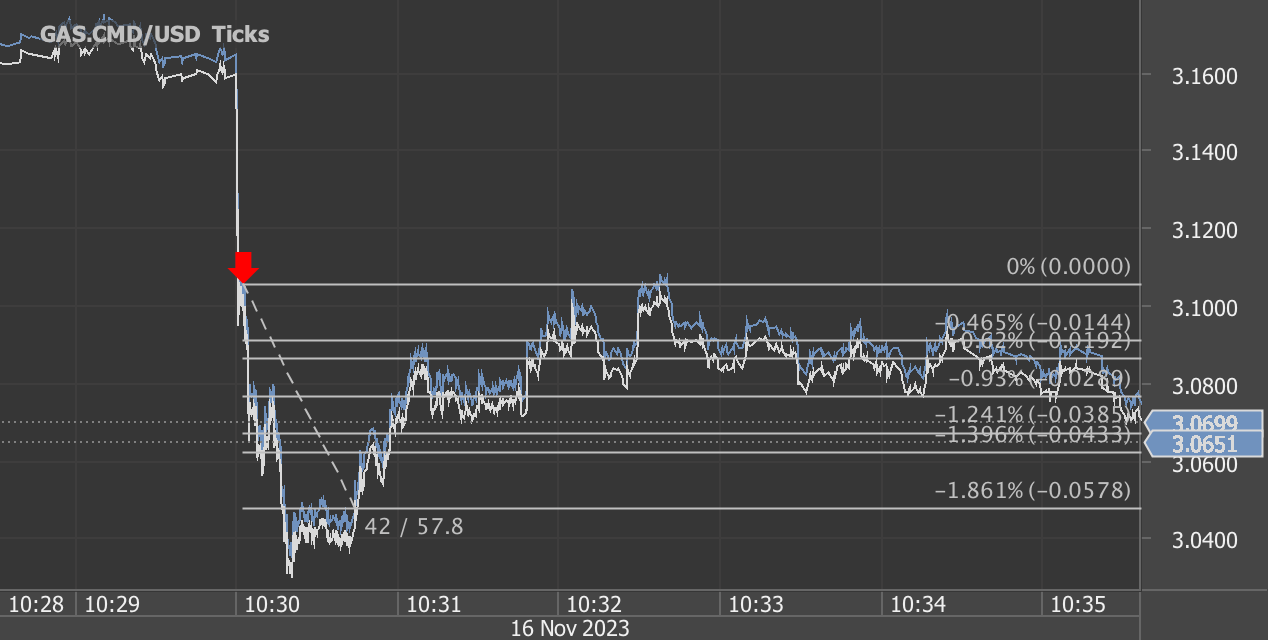

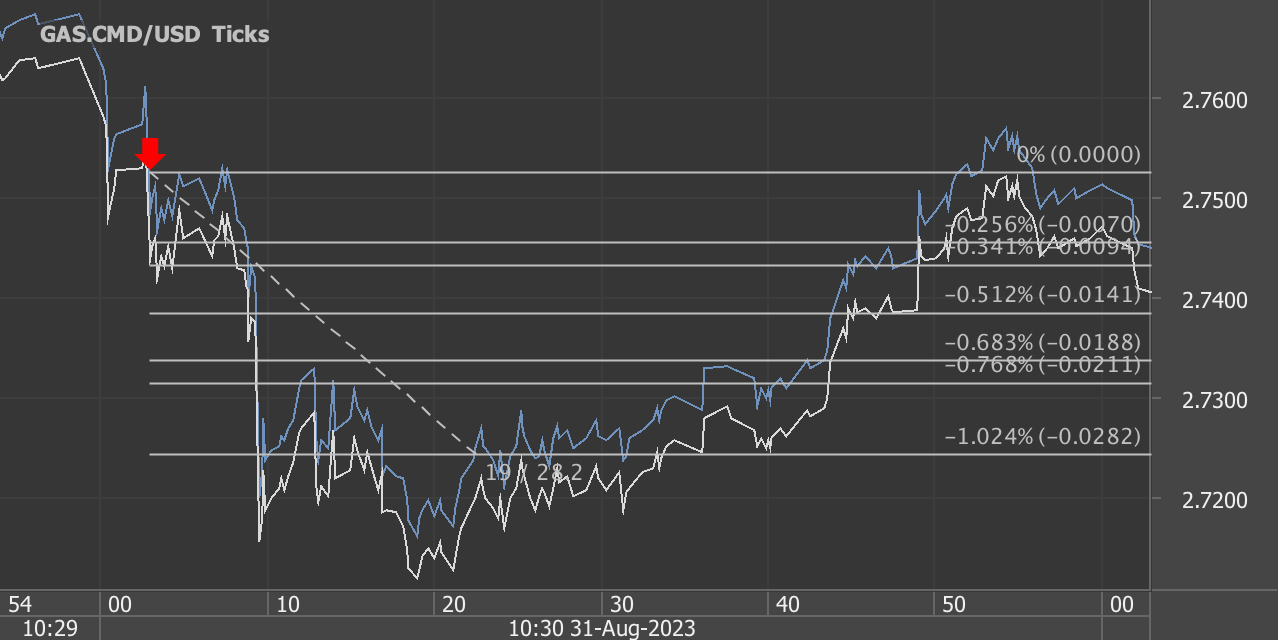

According to our analysis natural gas moved 21 ticks on DOE Natural Gas Storage Report data on 11 April 2024.

Natural gas (21 ticks)

Charts are exported from JForex (Dukascopy).

Understanding the Latest Trends in Natural Gas Storage: Insights from the April 11, 2024 EIA Report

The Energy Information Administration (EIA) has recently released its latest Weekly Natural Gas Storage Report, providing data up to April 5, 2024. This crucial update gives us insights into the state of natural gas storage across the United States, reflecting changes over the past week and comparisons with historical data. Here’s a deep dive into what these numbers mean and their potential implications for the market and consumers.

Current Storage Levels and Weekly Changes

As of April 5, 2024, the total working gas in underground storage in the Lower 48 states stood at 2,283 billion cubic feet (Bcf). This marks a net increase of 24 Bcf from the previous week. Notably, the current storage levels are significantly above last year's figures at this time, which were at 1,848 Bcf, and also surpass the five-year average of 1,650 Bcf. This indicates a robust increase in gas storage, suggesting a stronger storage position relative to previous years.

Regional Analysis

The report details specific changes in various regions:

East: A slight decrease of 1 Bcf, totaling 362 Bcf.

Midwest: An increase of 2 Bcf, reaching 512 Bcf.

Mountain: An increase of 3 Bcf, now at 165 Bcf.

Pacific: Also up by 2 Bcf, totaling 229 Bcf.

South Central: The largest increase observed here, with 18 Bcf added, now totaling 1,014 Bcf.

Each region shows different trends, but overall, the increases are contributing to a greater national storage capacity, which could influence gas prices and energy policy.

Year-on-Year and Five-Year Comparisons

The comparison with last year and the five-year average gives us an idea of the long-term trends affecting natural gas storage:

The total stocks are 23.5% higher than the same time last year.

They are also 38.4% above the five-year average.

These significant increases could be due to various factors, including changes in production levels, shifts in energy consumption patterns, or preemptive storage in anticipation of different market conditions.

Implications for Markets and Consumers

With natural gas storage levels being well above average, this could lead to a stabilizing effect on natural gas prices, barring any sudden increases in demand or major geopolitical events. Consumers might benefit from relatively stable or possibly lower energy prices in the near term. However, energy producers might face challenges with lower prices affecting their revenue streams.

Future Outlook

Looking ahead, the next update scheduled for April 18, 2024, will provide further insights into the trends we're observing. Monitoring these trends is crucial for market participants and policymakers to make informed decisions.

In conclusion, the latest EIA report highlights a strong position in natural gas storage compared to previous years. This situation presents both opportunities and challenges in the energy market. As always, it will be important to keep an eye on how these trends evolve in response to economic, environmental, and political factors.

Source: https://ir.eia.gov/ngs/ngs.html

Start futures forex fx commodity news trading with Haawks G4A low latency machine-readable data, one of the fastest data feeds for DOE data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.