According to our analysis USDJPY and EURUSD moved 20 pips on US BLS CPI (Consumer Price Index) data on 12 March 2024.

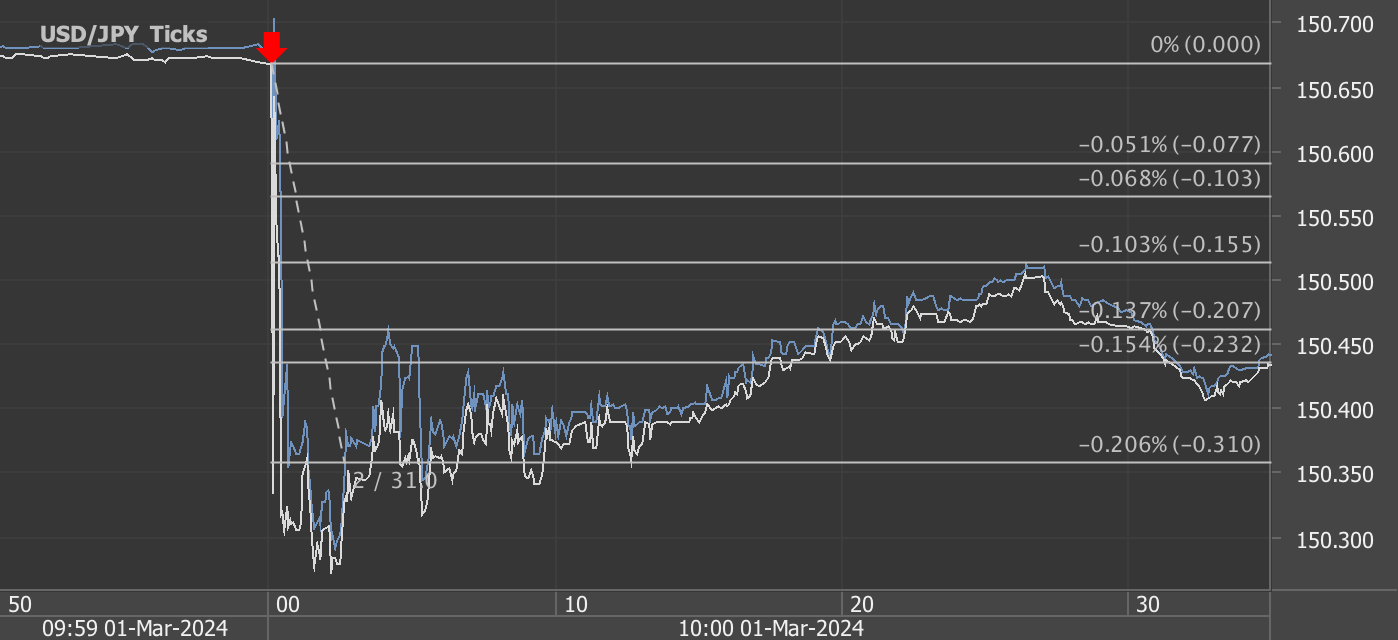

USDJPY (12 pips)

EURUSD (8 pips)

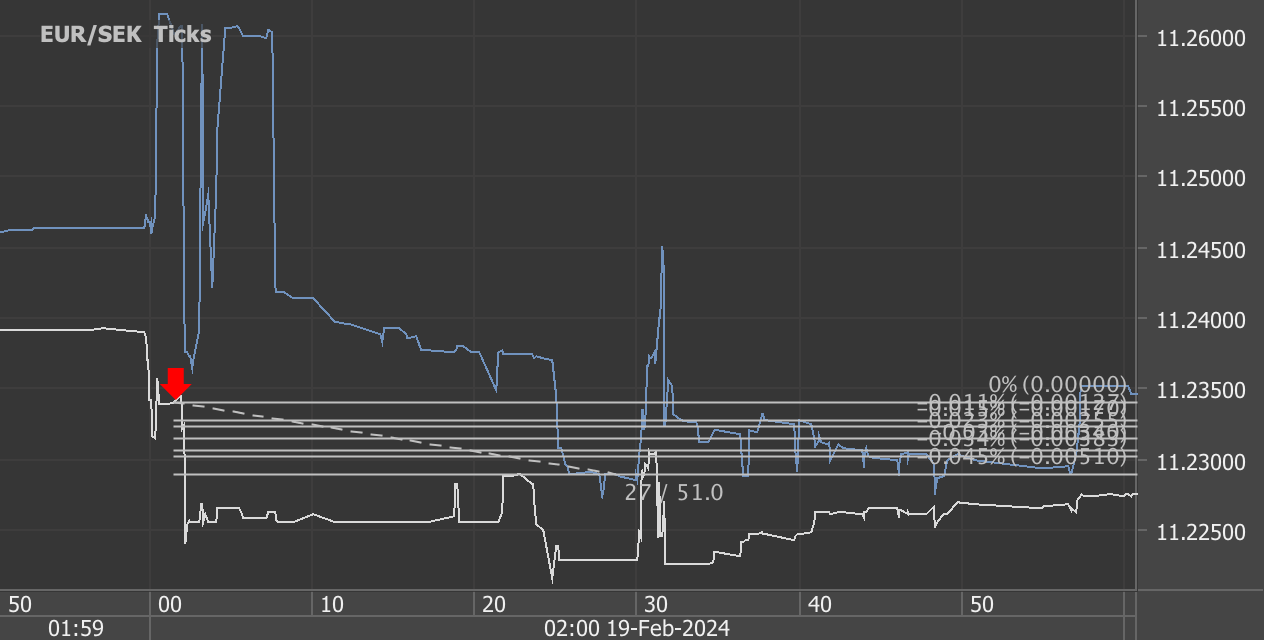

Charts are exported from JForex (Dukascopy).

Understanding the February 2024 Consumer Price Index Report: A Deep Dive

The Consumer Price Index (CPI) for February 2024 was released by the U.S. Bureau of Labor Statistics (BLS), marking an essential gauge for economists, policymakers, and consumers to understand the current economic climate and inflation trends. The CPI measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Let's dive into the details of the February 2024 report to unpack what it means for the economy and individuals.

February 2024 CPI Highlights

In February 2024, the Consumer Price Index for All Urban Consumers (CPI-U) saw a seasonally adjusted increase of 0.4 percent, following a 0.3 percent rise in January. This incremental change points to a persistent upward pressure on prices across a broad array of goods and services. Over the past 12 months, the all items index has risen by 3.2 percent before seasonal adjustment, indicating a slight acceleration in inflationary pressures.

Key Contributors to the February Increase

Several key components contributed to the February rise in the CPI-U:

Shelter and Gasoline: The indexes for shelter and gasoline saw significant increases in February, together accounting for over sixty percent of the monthly rise in the all items index. This combination of higher housing and fuel costs can strain household budgets.

Energy: The energy index increased by 2.3 percent, with all its component indexes also on the rise, adding to the overall inflationary pressure.

Food: Interestingly, the food index remained unchanged in February, with both the food at home and food away from home indexes showing little to no growth. This stability in food prices offers a slight reprieve amidst the broader inflationary trends.

Annual Perspective

Looking at the annual figures, the all items index increased by 3.2 percent over the 12 months ending February 2024, a notch above the 3.1 percent increase for the year ending in January. Notably, the energy index decreased by 1.9 percent over this period, providing a mixed picture of the inflationary landscape.

Analyzing the Numbers: What This Means for You

The February 2024 CPI report underscores ongoing inflationary pressures within the U.S. economy. For consumers, the rise in shelter and gasoline prices could lead to higher living expenses, affecting budgets and spending habits. On the flip side, the stabilization in food prices, albeit temporary, offers some relief.

For policymakers, the report's insights into inflationary trends are crucial for shaping monetary policy and interest rate decisions. The data presents a balancing act between stimulating economic growth and curbing inflation to maintain price stability.

Looking Ahead

As we move forward into 2024, all eyes will be on the evolving economic indicators and their implications for inflation, consumer spending, and monetary policy. The Consumer Price Index, as a primary measure of inflation, will continue to play a pivotal role in these discussions. The next CPI report, scheduled for release in April 2024, will be eagerly awaited for further clues on the direction of the U.S. economy.

In summary, the February 2024 CPI report highlights the nuanced landscape of inflationary pressures facing the U.S. economy. While certain sectors like energy and shelter are driving price increases, the overall picture is complex, with stabilizing food prices providing a counterbalance. Understanding these dynamics is essential for navigating the economic challenges and opportunities that lie ahead.

Source: https://www.bls.gov/news.release/cpi.nr0.htm

Start futures forex fx news trading with Haawks G4A low latency machine-readable data, one of the fastest machine-readable news trading feed for US economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.