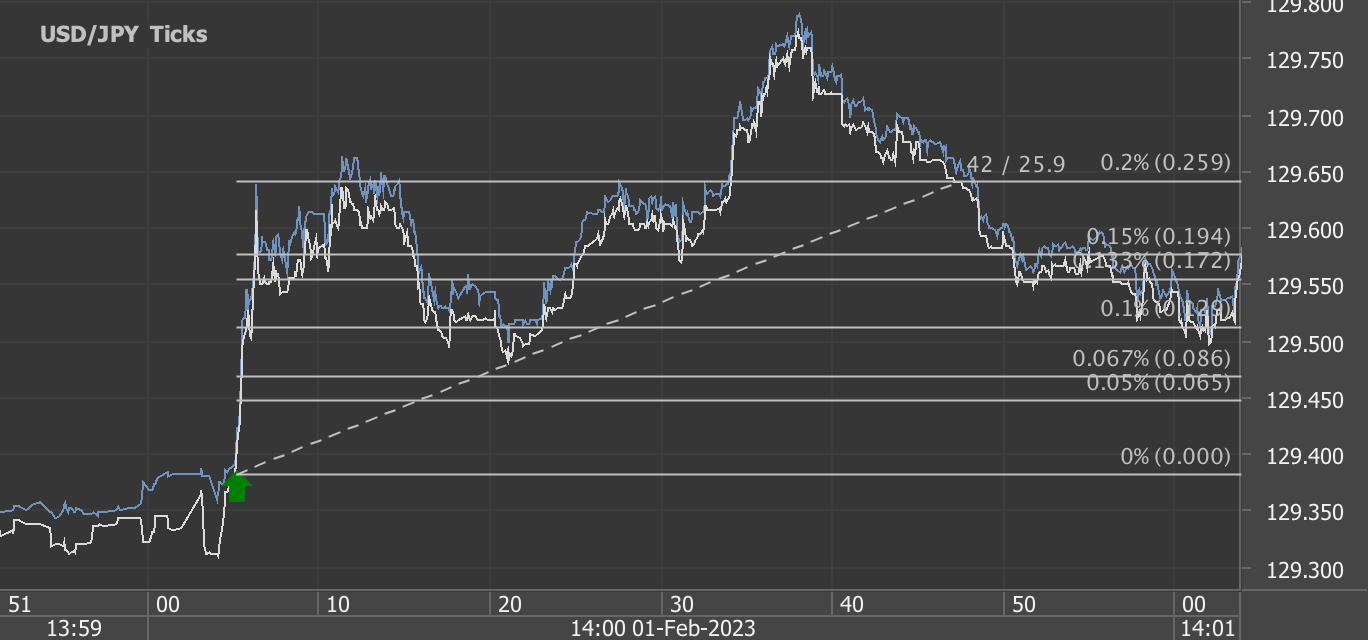

According to our analysis USDJPY and EURUSD moved 36 pips on FOMC Interest Rate Decision and Projections data on 18 December 2024.

USDJPY (13 pips)

EURUSD (23 pips)

Charts are exported from JForex (Dukascopy).

Federal Reserve Cuts Interest Rates and Releases Updated Economic Projections for 2024-2027

Date: December 18, 2024

The Federal Reserve has made headlines today by not only cutting the federal funds rate by 0.25 percentage points to a target range of 4.25% to 4.5% but also releasing its latest Summary of Economic Projections (SEP). These projections outline the Federal Open Market Committee’s (FOMC) expectations for key economic indicators, including GDP growth, unemployment, and inflation, through 2027.

Key Economic Projections for 2024-2027

The SEP provides a detailed look at the anticipated trajectory of the U.S. economy, offering insight into where the Fed believes things are headed under current policy assumptions. Here’s a breakdown of the highlights:

1. Real GDP Growth

2024: Projected to grow by 2.5% (up from 2.0% in the September projection).

2025: Growth slows slightly to 2.1%.

2026: Expected at 2.0%.

2027: Further tapering to 1.9%.

Longer Run: A sustainable growth rate of 1.8%.

Context: The upward revision in 2024’s GDP projection reflects confidence in the economy’s resilience, despite higher interest rates throughout the year. Growth is anticipated to gradually moderate over the longer term.

2. Unemployment Rate

2024: Median projection of 4.2%.

2025-2027: Steady at 4.3%.

Longer Run: Expected to stabilize at 4.2%.

Context: While the labor market is expected to ease slightly, unemployment projections remain historically low, indicating a relatively healthy job market.

3. PCE Inflation (Personal Consumption Expenditures)

2024: Projected at 2.4%.

2025: Slight increase to 2.5%.

2026: Moderates to 2.1%.

2027: Aligns with the Fed’s target at 2.0%.

Longer Run: Stable at 2.0%.

Context: Inflation remains a key concern, but projections suggest the Fed expects to achieve its 2% goal by 2027.

4. Core PCE Inflation (Excluding Food and Energy)

2024: 2.8%.

2025: Drops to 2.5%.

2026: Further down to 2.2%.

2027: Aligns with the target at 2.0%.

Context: Core inflation, which excludes volatile food and energy prices, is projected to remain slightly elevated in the near term before converging with the overall inflation target.

5. Federal Funds Rate

2024: Projected to end at 4.4%.

2025: Declines to 3.9%.

2026: Further reduces to 3.4%.

2027: Expected to stabilize at 3.1%.

Longer Run: Settles at 3.0%.

Context: The Fed’s policy path suggests a gradual easing of interest rates over the next few years, reflecting confidence that inflation will continue to cool while supporting economic growth.

What Does This Mean for the Economy?

1. Growth with Stability

The upward revision of 2024 GDP growth indicates the economy is performing better than previously expected. While growth is expected to moderate, it’s not anticipated to stall, suggesting a soft landing rather than a recession.

2. Labor Market Resilience

The projected unemployment rate remains low, indicating that even as the economy adjusts to higher interest rates, the job market is expected to remain resilient. This provides reassurance for workers and consumers.

3. Inflation Under Control

The Fed’s inflation projections suggest confidence that price pressures will continue to ease. Achieving the 2% inflation target by 2027 will be a key milestone for restoring economic stability.

4. Gradual Rate Cuts

With the federal funds rate projected to decline gradually over the next few years, borrowing costs for consumers and businesses are likely to decrease. This could support investments in housing, business expansion, and consumer spending.

Market Reactions and Future Policy

Despite the Fed’s rate cut and optimistic projections, the stock market declined following the announcement. Investors appear to remain wary of lingering uncertainties surrounding the economy, inflation, and future policy adjustments. The market’s reaction underscores concerns about potential risks to growth and the Fed’s ability to navigate these challenges effectively.

Conclusion: A Measured Approach to Monetary Policy

The Fed’s decision to cut rates and its detailed economic projections signal a measured approach to navigating economic uncertainty. The central bank remains committed to fostering maximum employment and price stability while adapting to changing conditions.

As we move into 2025, all eyes will be on inflation trends, labor market conditions, and the Fed’s ongoing policy decisions. For now, today’s actions provide cautious optimism that the U.S. economy can continue to grow while keeping inflation under control, though market sentiment remains cautious.

Source: https://www.federalreserve.gov/newsevents/pressreleases/monetary20241218a.htm, https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20241218.htm

Start futures forex fx news trading with Haawks G4A low latency machine-readable data, one of the fastest machine-readable news trading feeds for US macro-economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.