According to our analysis USDJPY moved 23 pips, US30 moved 147 points and Bitcoin (BTC) moved 1279 points on US BLS Consumer Price Index (CPI) data on 12 February 2025.

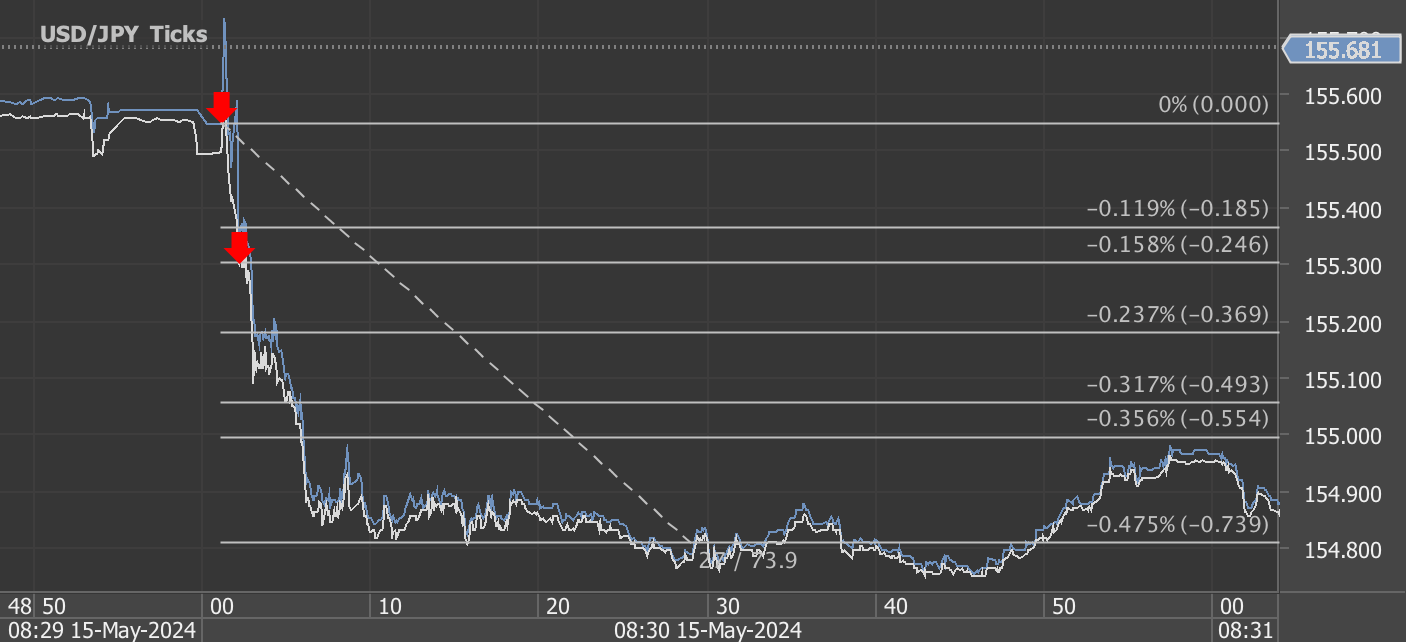

USDJPY (23 pips)

US30 (147 points)

Bitcoin BTC (1279 points)

Charts are exported from JForex (Dukascopy).

CPI Report Shakes Markets: USD/JPY Gains, US30 Drops, BTC Dips

The January 2025 Consumer Price Index (CPI) report released by the Bureau of Labor Statistics showed a higher-than-expected inflation increase of 0.5% month-over-month, bringing the annual CPI to 3.0%. This data immediately sent ripples through the financial markets, impacting major asset classes, including forex, equities, and crypto.

Key CPI Highlights:

Headline CPI: +0.5% (MoM), +3.0% (YoY)

Core CPI (Ex-Food & Energy): +0.4% (MoM), +3.3% (YoY)

Shelter Costs: +0.4% MoM, a major driver of inflation

Energy Index: +1.1% MoM, fueled by a 1.8% increase in gasoline prices

Food Index: +0.4% MoM, with food-at-home prices up 0.5%

Market Reaction:

Forex – USD/JPY Rises 23 Pips

The U.S. dollar strengthened against the Japanese yen, with USD/JPY climbing 23 pips post-release. This move reflects increased expectations that the Federal Reserve may need to maintain higher interest rates for longer to combat inflation. The resilience of core CPI above 3.0% further solidifies the Fed’s hawkish stance, making USD more attractive compared to JPY, which remains under the Bank of Japan’s ultra-loose policy.

Equities – US30 Drops 147 Points

Wall Street reacted negatively to the inflation data, with the Dow Jones Industrial Average (US30) falling 147 points. Investors are concerned that persistent inflation may delay any potential Fed rate cuts, dampening risk appetite. Additionally, rising costs for shelter and transportation services indicate that consumer spending power could take a hit, affecting corporate earnings.

Crypto – Bitcoin Drops 1,279 Points

Bitcoin (BTC) saw a sharp decline of 1,279 points following the CPI release, reflecting a risk-off sentiment in the broader market. Higher-than-expected inflation led to speculation that Fed policy will remain tight, reducing liquidity for riskier assets like crypto. BTC’s drop also aligns with a broader sell-off in tech and growth stocks, which tend to be more sensitive to interest rate outlooks.

Final Thoughts

Traders should brace for continued volatility as inflation concerns linger. The next major catalyst will be the Fed’s response in upcoming meetings and market reactions to any further economic data releases. Stay alert to potential breakout moves in USD/JPY, US30, and BTC as inflation trends develop.

Disclaimer: This blog post is for informational purposes only and should not be construed as financial advice. Always conduct thorough research and consider seeking advice from a financial professional before making any investment decisions.

Start futures forex fx news trading with Haawks G4A low latency machine-readable data, one of the fastest machine-readable news trading feed for US macro-economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.