According to our analysis USDJPY and EURUSD moved 27 pips on US BLS Consumer Price Index (CPI) data on 11 September 2024.

USDJPY (17 pips)

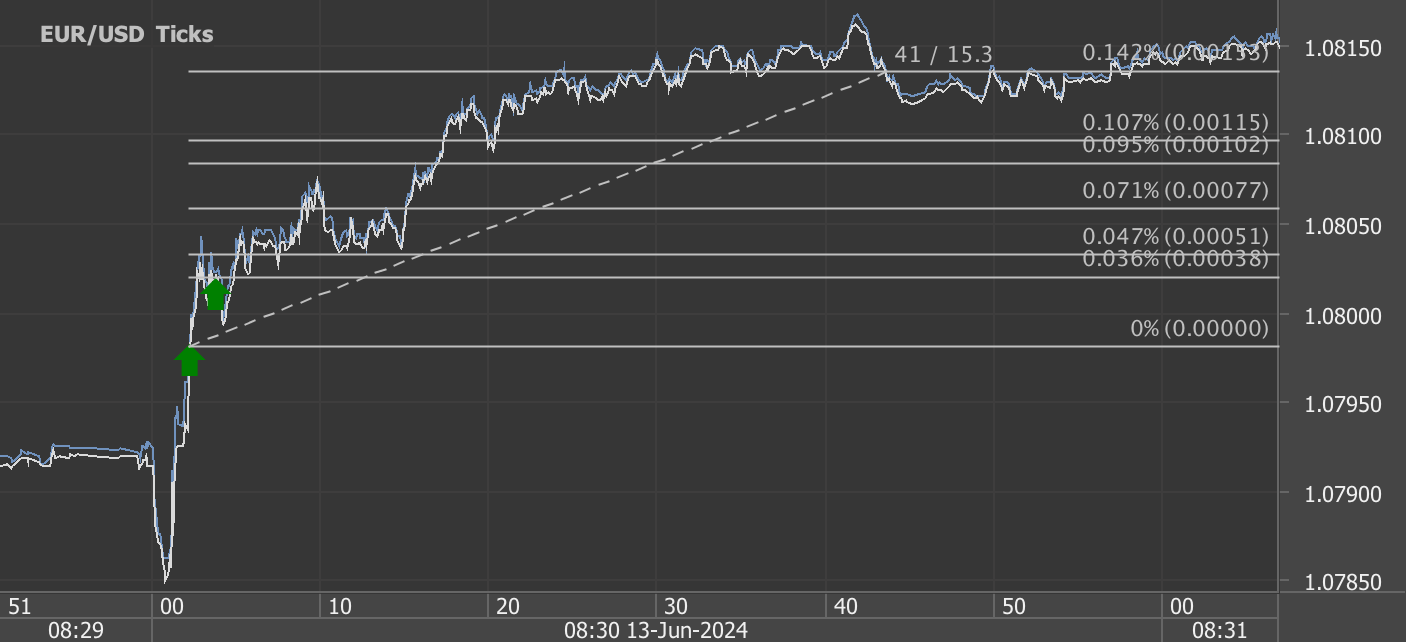

EURUSD (10 pips)

Charts are exported from JForex (Dukascopy).

Understanding the Latest CPI Data: Key Takeaways from August 2024

The Consumer Price Index (CPI) for August 2024 reveals subtle yet important trends in the U.S. economy. According to the U.S. Bureau of Labor Statistics, the CPI for All Urban Consumers (CPI-U) rose by 0.2 percent on a seasonally adjusted basis, maintaining the same rate of increase as observed in July. Over the past 12 months, the index recorded a 2.5 percent increase before seasonal adjustments, marking a relatively modest inflationary trend compared to previous years.

Breakdown of CPI Components:

Shelter: The cost of shelter continued to be a significant driver of the overall index, rising by 0.5 percent in August, thus contributing majorly to the broader index's movement.

Food: Food prices saw a slight increase of 0.1 percent, with food away from home experiencing a higher rise of 0.3 percent compared to food at home, which remained unchanged.

Energy: Contrasting these increases, the energy index fell by 0.8 percent, influenced by a significant drop in gasoline and fuel oil prices.

Year-over-Year Analysis:

General Index: The all-items index increased by 2.5 percent over the year, the smallest 12-month rise since February 2021, indicating a cooling period after higher inflation rates experienced in recent years.

Core Inflation: Excluding volatile food and energy prices, core inflation was up by 3.2 percent year-over-year, suggesting underlying pressures remain despite the overall stabilization of the index.

Specific Categories: Noteworthy annual increases were seen in shelter (5.2 percent), while energy commodities experienced sharp declines, particularly gasoline and fuel oil, highlighting the fluctuating nature of energy markets.

Sector-Specific Insights:

Transportation: Airline fares notably increased by 3.9 percent in August after months of decline, likely reflecting seasonal travel adjustments and broader economic activities.

Medical and Apparel: Both sectors saw modest increases, indicating varied consumer spending behaviors across different areas.

Forward-Looking Implications:

The CPI data not only serves as a gauge of past and current economic conditions but also provides insights into potential future trends. The steadiness in core inflation suggests that while the economy faces inflationary pressures, they may be becoming more entrenched at a moderate level. This has implications for monetary policy, as policymakers must balance stimulating economic growth with preventing runaway inflation.

Consumer Impact:

For consumers, understanding the CPI is crucial as it affects everyday decision-making regarding spending, saving, and investing. The variations in food, energy, and housing costs directly impact budgeting and financial planning.

Conclusion:

As we look forward to the CPI data for September 2024, scheduled for release in October, stakeholders from policymakers to consumers should consider the nuanced changes in the CPI components. Staying informed will be key to navigating the economic landscape, which remains dynamic amid varying inflationary pressures.

Inflation continues to be a critical economic indicator that demands close monitoring. For those planning budgets or investments, keeping an eye on these trends can provide essential insights into timing and strategy adjustments necessary to safeguard financial health in an ever-changing economic environment.

Start futures forex fx news trading with Haawks G4A low latency machine-readable data, one of the fastest machine-readable news trading feed for US macro-economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.