According to our analysis USDJPY and EURUSD moved 12 pips on US BLS Producer Price Index (PPI) data on 14 May 2024.

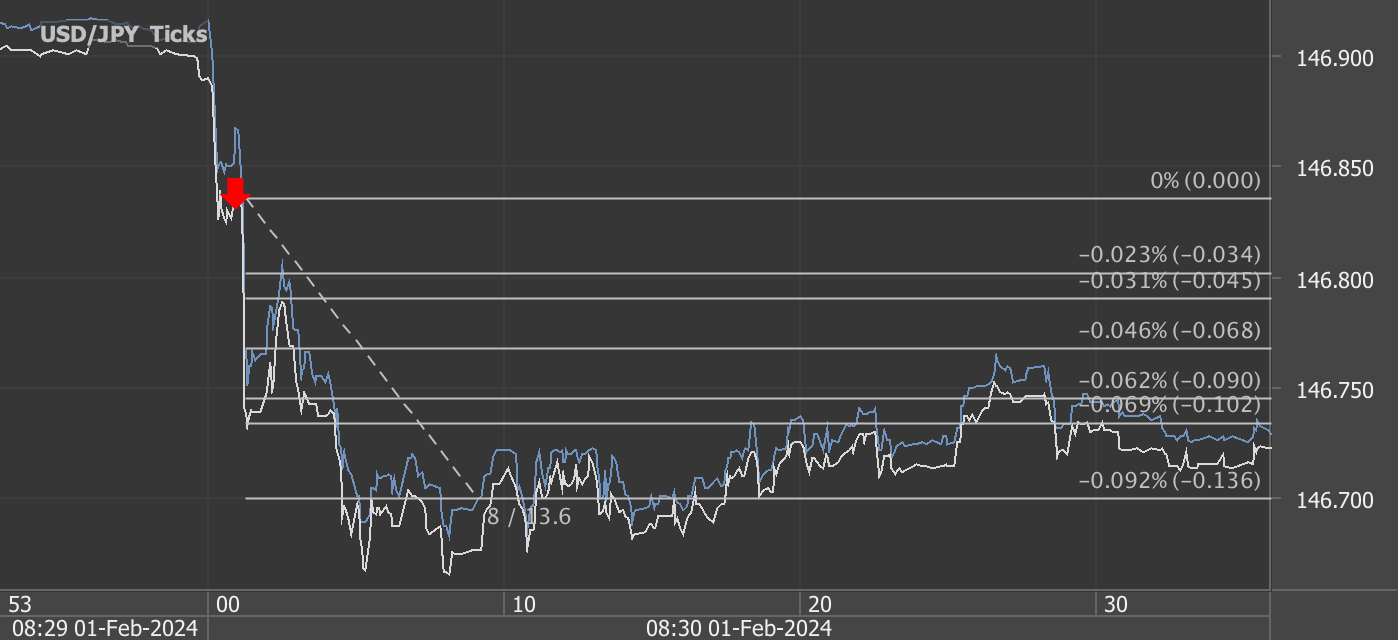

USDJPY (3 pips)

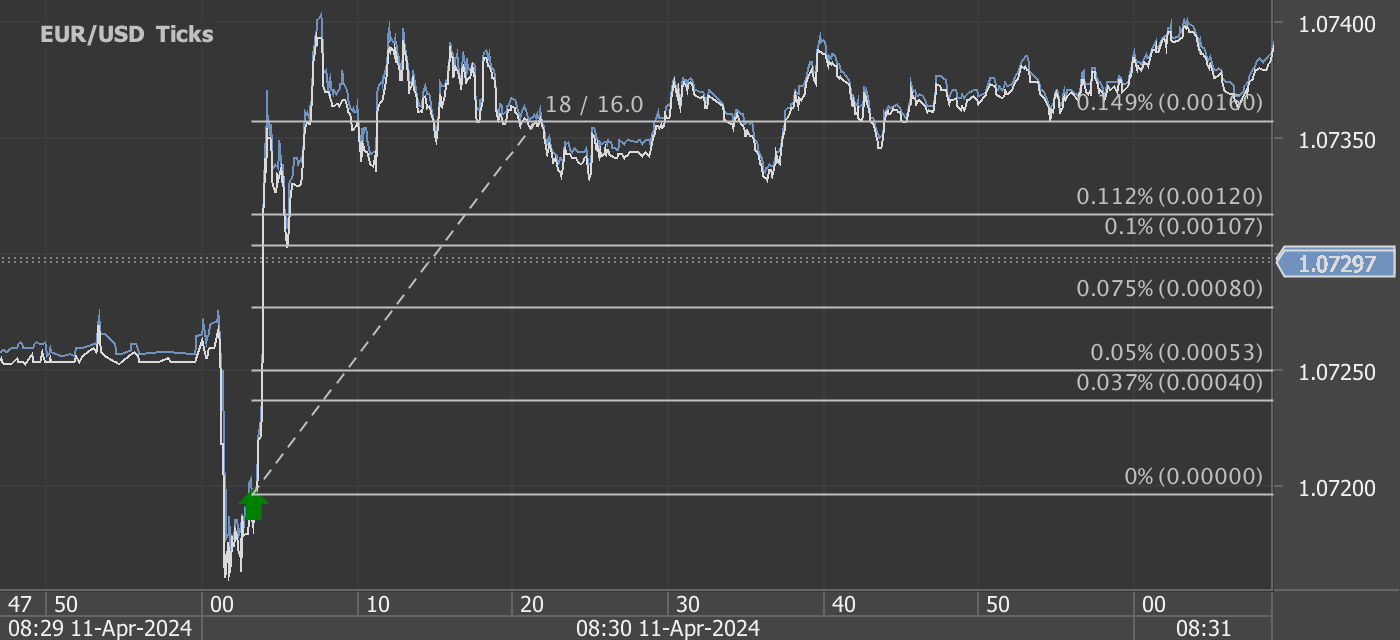

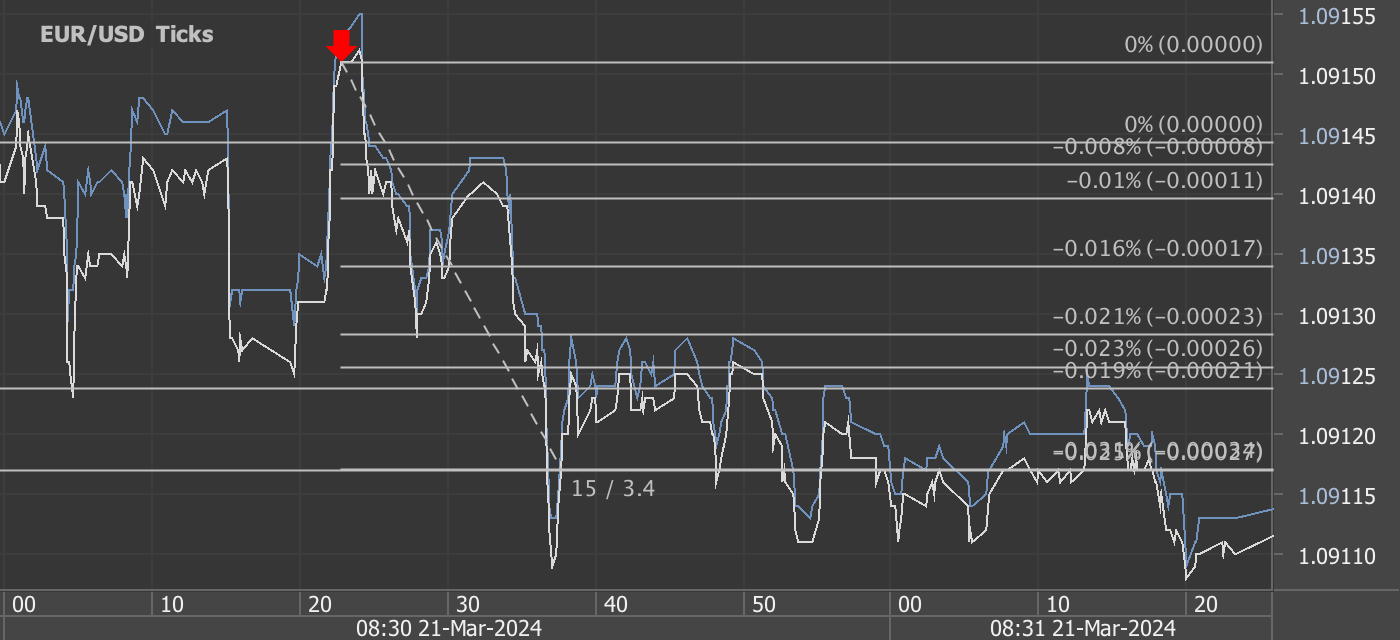

EURUSD (9 pips)

Charts are exported from JForex (Dukascopy).

Analyzing the April 2024 Producer Price Index (PPI) Increase: Key Takeaways and Economic Implications

The U.S. Bureau of Labor Statistics recently released the Producer Price Index (PPI) for April 2024, revealing a notable uptick of 0.5 percent on a seasonally adjusted basis. This increase comes after a slight decline of 0.1 percent in March and marks the largest rise since February's 0.6 percent gain. Over the past 12 months, the unadjusted index for final demand has risen by 2.2 percent, representing the most substantial annual increase since April 2023.

Breakdown of Key Components

1. Services Drive the Increase

Nearly three-quarters of April's rise can be attributed to the services sector, which saw a 0.6 percent increase, primarily driven by a significant 3.9 percent jump in portfolio management costs. Other contributing factors include higher prices in machinery and equipment wholesaling, residential real estate services, and truck transportation of freight.

2. Goods Also Up

Final demand goods increased by 0.4 percent, primarily due to a 5.4 percent rise in gasoline prices, which accounted for most of the increase. Despite this, there was a contrasting decline in food prices, notably a steep 18.7 percent drop in fresh and dry vegetables.

Deeper Insights: Excluding Volatile Sectors

When excluding foods, energy, and trade services, the index still shows a robust increase of 0.4 percent in April, following a 0.2 percent rise in March. This indicator is particularly telling as it excludes sectors that are typically volatile, providing a clearer picture of the underlying inflation trends. Year-over-year, this measure has seen a 3.1 percent increase, the largest since April 2023.

Implications for Economic Policy and Business Planning

The latest PPI data suggests underlying inflationary pressures in the economy, particularly in the services sector. Businesses, especially in sectors directly impacted by rising service costs, will need to adjust their pricing strategies and budgeting plans to accommodate these cost increases. Moreover, policymakers may need to consider these trends when designing monetary policy to ensure inflation targets are met without stifling economic growth.

Future Outlook

Given the PPI's role as a leading indicator of consumer price inflation, the April increase might signal upcoming changes in consumer prices, potentially affecting the Federal Reserve's decisions on interest rates. The economic landscape remains dynamic, and these price trends provide critical insights into the broader economic health.

As we look forward to the May 2024 PPI report scheduled for release on June 13, businesses and policymakers alike must stay vigilant and responsive to these evolving economic indicators.

This data not only helps in anticipating economic trends but also serves as a crucial tool for financial planning and analysis, ensuring stakeholders are well-prepared to navigate the complexities of an ever-changing economic environment.

Start futures forex fx news trading with Haawks G4A low latency machine-readable data, one of the fastest machine-readable news trading feed for US economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.