According to our analysis USDJPY and EURUSD moved around 58 pips on US Employment Situation (Non-farm payrolls / NFP) data on 7 June 2024.

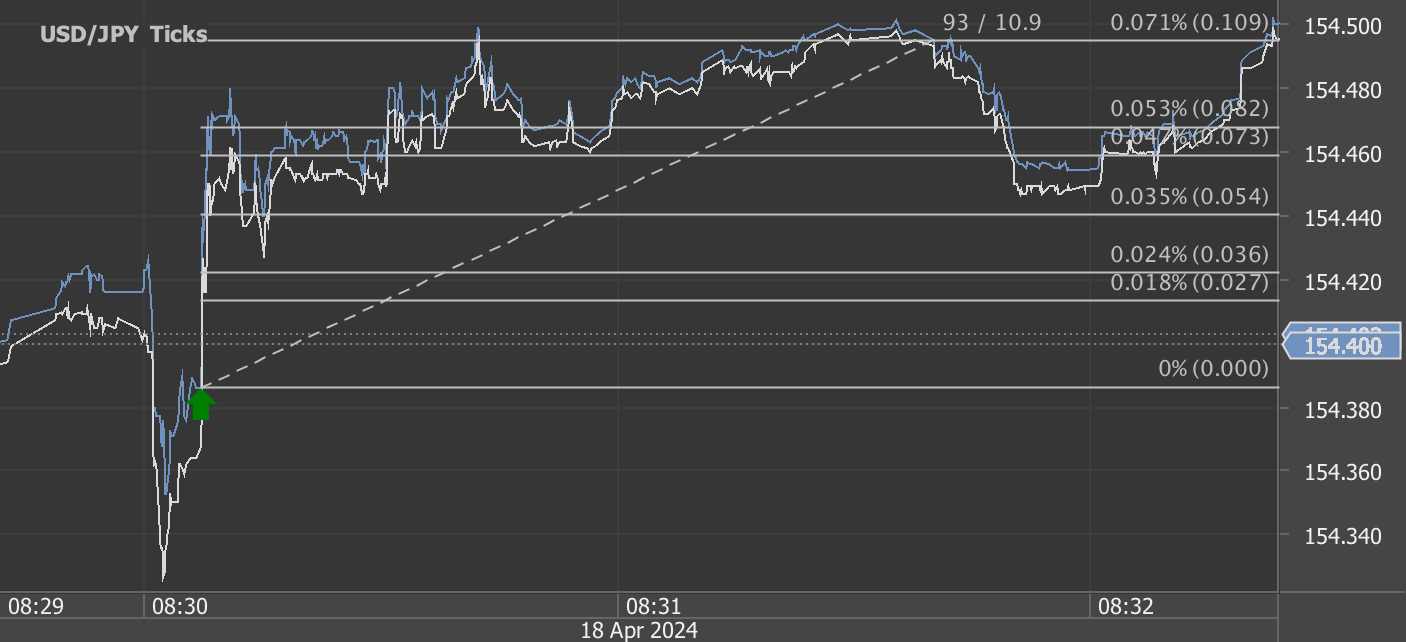

USDJPY (38 pips)

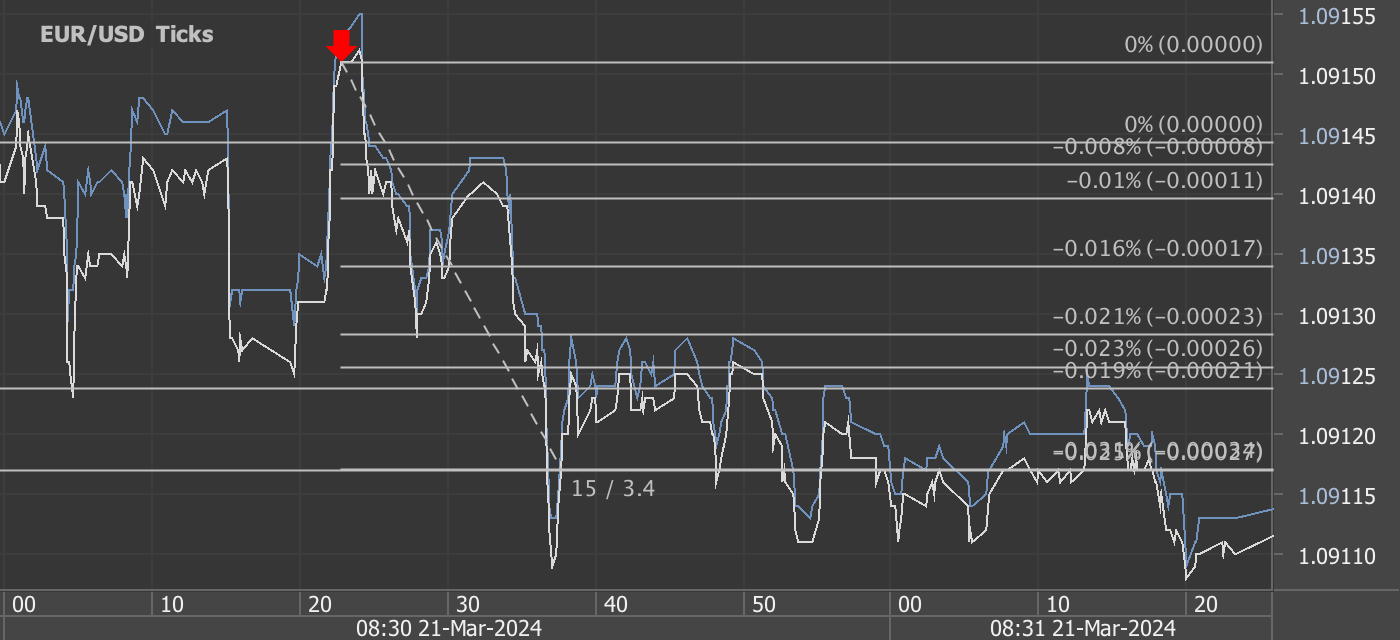

EURUSD (20 pips)

Charts are exported from JForex (Dukascopy).

Analyzing the May 2024 U.S. Employment Report: Trends and Implications

The latest Employment Situation Summary released by the U.S. Bureau of Labor Statistics provides an insightful glimpse into the current state of the nation's job market as of May 2024. A robust addition of 272,000 jobs indicates continuing growth across multiple sectors, maintaining a stable unemployment rate of 4.0 percent. This post delves into the details of the report, highlighting key trends and what they might mean for the economy and job seekers.

Key Highlights from the May 2024 Report

Continued Growth in Key Sectors: The health care, government, leisure and hospitality, and professional, scientific, and technical services sectors led job additions for the month. Notably, health care saw an addition of 68,000 jobs, aligning with its average monthly gain, signaling ongoing robust demand in this sector.

Stable Unemployment Rates: The unemployment rate held steady at 4.0 percent, with little change across major worker groups. Adult men and women posted unemployment rates of 3.8 percent and 3.4 percent respectively, while the unemployment rate for teenagers was significantly higher at 12.3 percent.

Part-Time and Marginal Attachments: Approximately 4.4 million individuals were employed part-time for economic reasons, unchanged from the previous month. Additionally, 1.5 million people were marginally attached to the labor force, including 462,000 discouraged workers who believe no jobs are available for them.

Economic Trends and Labor Market Dynamics

The stability in unemployment rates combined with significant job growth in sectors like health care and technical services suggests a maturing recovery phase as the economy rebounds from previous disruptions. The consistency in sectors like health care underscores the critical demand for healthcare services, possibly driven by an aging population and greater health consciousness post-pandemic.

Government job increases also reflect ongoing public sector investments, which often provide a stabilizing effect on employment during economic fluctuations. Meanwhile, the leisure and hospitality sector's recovery is indicative of restored consumer confidence and spending levels.

Challenges and Opportunities

Despite the overall positive outlook, there remain areas of concern, such as the high unemployment rate among teenagers and the substantial number of individuals working part-time due to economic conditions. These issues highlight the need for targeted policy interventions, such as improved job training and education programs, especially for younger workers.

The slight increase in discouraged workers also suggests that some segments of the population are not feeling the benefits of economic recovery, possibly due to skills mismatches or geographic disparities in job availability.

Forward Outlook

Looking ahead, the labor market appears to be on a stable trajectory, but with some areas needing attention to ensure broader participation and benefits from economic growth. Employers and policymakers alike should focus on inclusive growth strategies that address the needs of the most vulnerable populations.

The next Employment Situation Summary, slated for release in early July, will be closely watched for signs of whether these trends continue, especially in terms of wage growth and labor force participation rates.

Overall, the May 2024 employment report paints a picture of a resilient U.S. job market, with ongoing opportunities tempered by challenges that need to be managed to sustain long-term economic health.

Start forex fx futures news trading with Haawks G4A low latency machine-readable data today, one of the fastest news data feeds for US economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.