According to our analysis USDJPY and EURUSD moved 67 pips and US30 104 points on FOMC Interest Rate Decision and Projections data on 13 December 2023.

USDJPY (37 pips)

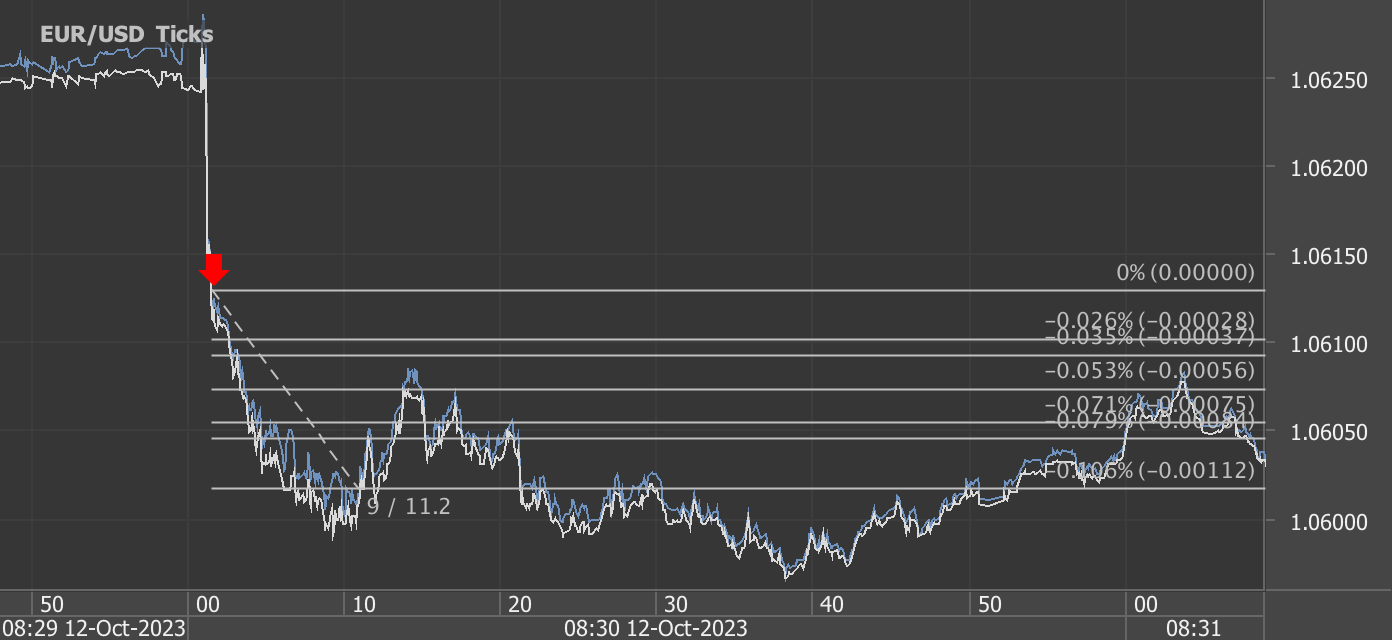

EURUSD (30 pips)

US30 (104 points)

Charts are exported from JForex (Dukascopy).

FOMC Projections - December 13, 2023

Summary of Economic Projections:

Real GDP Growth:

2023:

December projection: Median 2.6%

September projection: Median 2.1%

2024:

December projection: Median 1.4%

September projection: Median 1.5%

Unemployment Rate:

2023:

December projection: Median 3.8%

September projection: Median 3.8%

2024:

December projection: Median 4.1%

September projection: Median 4.1%

PCE Inflation:

2023:

December projection: Median 2.8%

September projection: Median 3.3%

2024:

December projection: Median 2.4%

September projection: Median 2.5%

Core PCE Inflation:

2023:

December projection: Median 3.2%

September projection: Median 3.7%

2024:

December projection: Median 2.4%

September projection: Median 2.6%

Federal Funds Rate (Projected Appropriate Policy Path):

2023:

December projection: Median 5.4%, Range 5.4–5.4%.

September projection: Median 5.6%, Range 5.4–5.6%.

2024:

December projection: Median 4.6%, Range 4.4–4.9%.

September projection: Median 5.1%, Range 4.6–5.4%.

2025:

December projection: Median 3.6%, Range 3.1–3.9%.

September projection: Median 3.9%, Range 3.4–4.9%.

2026:

December projection: Median 2.9%, Range 2.5–3.1%.

September projection: Median 2.9%, Range 2.5–4.1%.

Longer Run:

December projection: Median 2.5%, Range 2.4–3.8%.

September projection: Median 2.5%, Range 2.4–3.8%.

Comparison with September Projections:

GDP growth projections for 2023 have increased from 2.1% to 2.6%.

Unemployment rate projections for 2023 remain at 3.8%, while projections for 2024 have increased slightly.

PCE inflation projections for 2023 have decreased from 3.3% to 2.8%.

Core PCE inflation projections have decreased across all years.

The projections for the federal funds rate have generally decreased for each year from 2023 to the longer run.

The median projections for 2023 and 2024 are slightly lower in December compared to September.

The ranges for 2023 and 2024 are narrower in December, indicating a bit more consensus among participants.

The longer-run median and range are consistent between December and September.

Summary of the FOMC Statement - December 13, 2023:

Economic activity has slowed from its strong pace in Q3.

Job gains have moderated, but the unemployment rate remains low.

Inflation has eased over the past year but remains elevated.

The U.S. banking system is sound, but tighter financial conditions may impact economic activity, hiring, and inflation.

The federal funds rate target range is maintained at 5-1/4 to 5-1/2 percent.

The Committee remains attentive to inflation risks and committed to returning inflation to its 2 percent objective.

The Committee will assess information for future policy decisions, considering the cumulative tightening of monetary policy and economic developments.

The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities.

Voting for the monetary policy action includes Powell, Williams, Barr, Bowman, Cook, Goolsbee, Harker, Jefferson, Kashkari, Kugler, Logan, and Waller.

Source: https://www.federalreserve.gov/newsevents/pressreleases/monetary20231213a.htm, https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20231213.htm

Start futures forex fx news trading with Haawks G4A low latency machine-readable data, one of the fastest machine-readable news trading feeds for US economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.